You’ll need to file the Articles of Organization for LLC, which the state calls the Delaware Certificate of Formation to get your Delaware LLC up and running. An LLC is a type of corporate structure that offers its members liability protection. Additionally, it may be flexible and has some tax efficiency. Corporations, individuals, other LLCs, and even foreign organizations can all be members of an LLC.

In this blog, we put together this guide on the process for completing your LLC Articles of Organization and give suggestions on what you need to do after having this certificate.

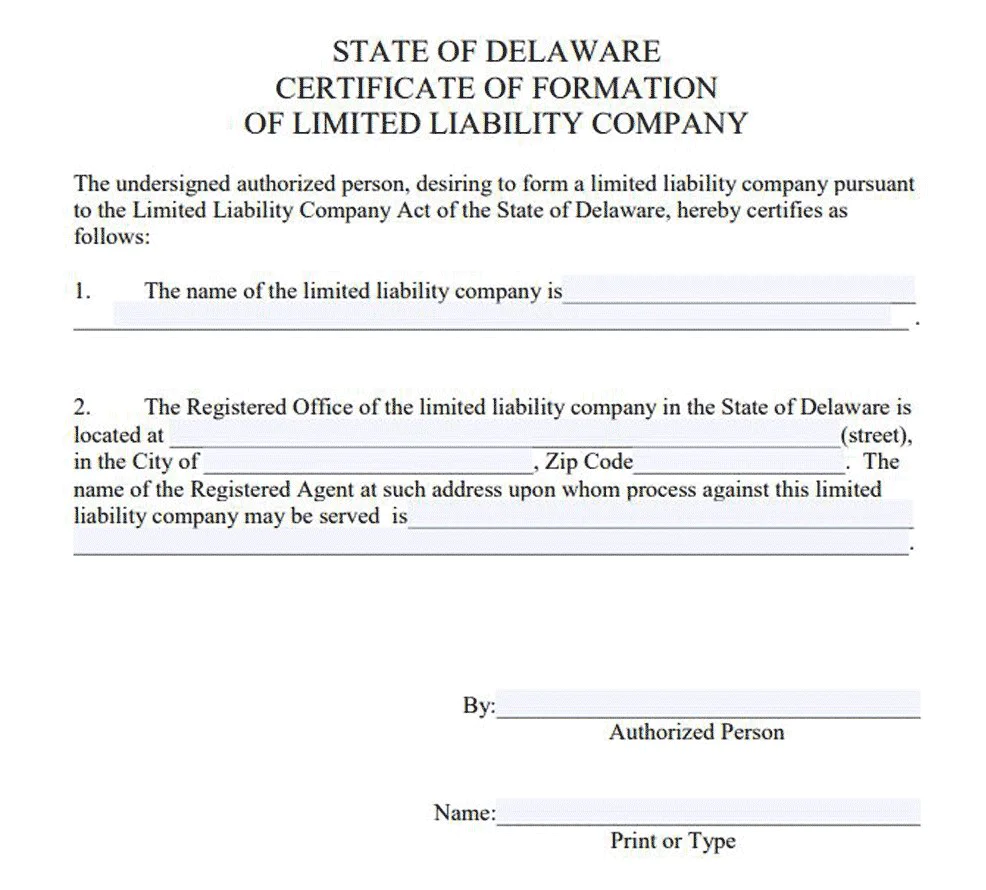

Overview Delaware LLC Certificate of Formation

The Delaware LLC Articles of Organization is a document that is filed and approved by the Secretary of State, Division of Corporations in order to establish a limited liability company.

This Certificate serves as your newly formed Delaware LLC’s birth certificate. A Certificate of Incorporation, which a corporation (as opposed to an LLC) obtains upon filing, should not be confused with this.

Your original Certificate of Formation, which will be sent to you via email, is a document in black and white with a time and date stamp in the corner proving it has been authorized by the Delaware Secretary of State.

This Articles includes 3 components listed below:

- The name of your LLC

- The registered address of the LLC office

- The location and contact information for your LLC Registered Agent

A sample of the Articles of Organization

How to submit Delaware LLC Certificate of Formation?

Pre-registration

Before filling Certificate of Formation, you should choose an LLC official name and its name must include “Limited Liability Company,” “L.L.C.,” or “LLC” in Delaware. Your company name can be reserved for successive 120-day periods while you finish your Certificate of Formation. For process-serving purposes, you must list a Registered Agent including its name and address. A Delaware-based individual or business serving as your company’s registered agent will accept and deliver official mail.

Submitting process

According to the Diamond State law, an LLC is a corporation having at least one member and one or more qualified individuals needed to fulfill the signature. By signing, the individual certifies that they correctly and truthfully filled out the certificate with the intention of forming a Delaware LLC. In addition, you can decide on a filing date if you want your certificate to go into effect later.

Steps to Finishing Your Delaware LLC

Obtain an employer identification number (EIN)

To obtain an EIN from the IRS, you will need to complete Form SS-4 and submit it either online or by mail. You can find more information on the IRS website. This number is used for tax purposes and will be required when opening a business bank account and filing taxes.

Open a business bank account

This will help you keep your personal and business finances separate, and make it easier to track expenses and income. In order to open a business bank account, you will need to provide your Delaware LLC Certificate of Formation, EIN, and contact information for the business. You can usually open a business bank account with a small deposit and no monthly fees.

Create an Operating Agreement

This agreement lays out the procedures for resolving disagreements between the LLC’s members and is signed by them. Consider the manner in which distributions will take place, the dates at which members will join or depart the LLC, and other operational concerns that may arise throughout the course of your company’s existence. If you don’t have an Operating Agreement, the Delaware LLC Act’s default standards will govern how disagreements are handled in court.

Get Licenses and Permits

Before forming an LLC, you must ascertain whether your business needs any licenses to operate legally. A few commercial activities necessitate obtaining federal licenses and/or permissions.

Learn how to get Delaware business licenses your company needs, or contact a company to handle it for you:

- Federal: Consult the U.S. Small Business Administration’s (SBA) guide on obtaining business licenses and permits from the federal government.

- State: Visit the First State’s One Stop website to submit an application or get additional information regarding licenses, permits, and registration.

- Local: Contact the county clerk in your area to know more about available licenses and permits.

Pay state tax obligations

You must pay all of your state tax obligations in order to finish the process and be recognized as an official business in the state. This includes any income, franchise, and/or withholding taxes. You can find more information on the Delaware Division of Revenue’s website.

ANNUAL COMPLIANCE

Gain more oversight into corporate compliance requirements of over 18 jurisdictions. Get your results now!

![]() Compact view of your company’s regulatory

requirements

Compact view of your company’s regulatory

requirements

![]() A quick breakdown of key reporting timelines

A quick breakdown of key reporting timelines

Conclusion

It’s essential to obtain a Delaware certificate of Formation if you want to create a Delaware LLC. This document serves as evidence that your business is officially formed. We have plenty of experience forming LLCs in the First State, so we can assist you in getting everything in order so that your company may succeed in this growing environment.

Don’t hesitate to get in touch with us via service@bbcincorp.com or simply chat with one of our friendly consultants for advice on forming an LLC in the First State.

Frequently Asked Questions

What is the process for obtaining a Delaware Certificate of Good Standing?

The Delaware Certificate of Formation must be signed by a registered agent in the First State and must be accompanied by the filing fee. Once this is filed and approved, you will be issued a Certificate of Good Standing from the Division of Corporations. This certificate is proof that your LLC is in good standing with the state and can be used to open a bank account or apply for loans or other services.

If you need a Certificate of Good Standing, you can order one from the Division of Corporations.

Is Delaware Certificate of Formation the same as Articles of Organization?

Forming an LLC in the Diamond State requires you to submit the Articles of Organization for LLC. The state calls it the Certificate of Formation.

Is a lawyer required to incorporate an LLC in Delaware?

You don’t need a lawyer to form an LLC in Delaware. You can easily file the LLC Articles of Organization by following 6-step process in this blog. And if you want to hire a service provider, you can click here to get more information.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.