Offshore Company Registration in Delaware

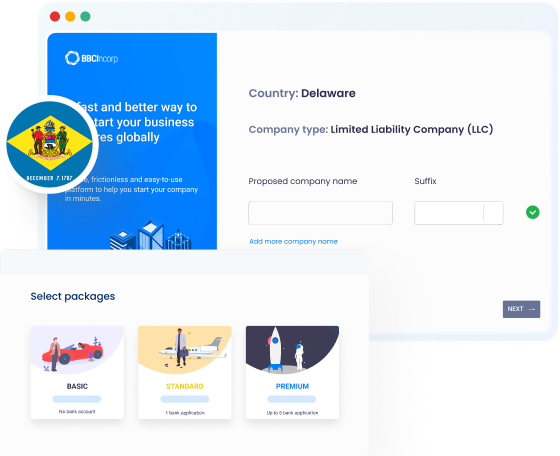

Delaware Company Formation Packages

With TaxHub, it is no longer a challenge fulfilling your Delaware LLC's tax filing as a non-US resident!

Exclusive offers for BBCIncorp clients:

- 10% discount code

- Free 30-minute CPA consultation

We connect directly with Wise to address any issues with your account

- Multi-currency business account

- Free support

Fuel your startup growth with Mercury banking solutions

- Custom-made for your needs

- $500 cash-back reward for $10k spent on your debit card within 90 days

Simplify your international business transactions with Payoneer

- Fast and simple cross-border payment

- Prioritized account and premium service

Bring your next business venture online

Streamlined process

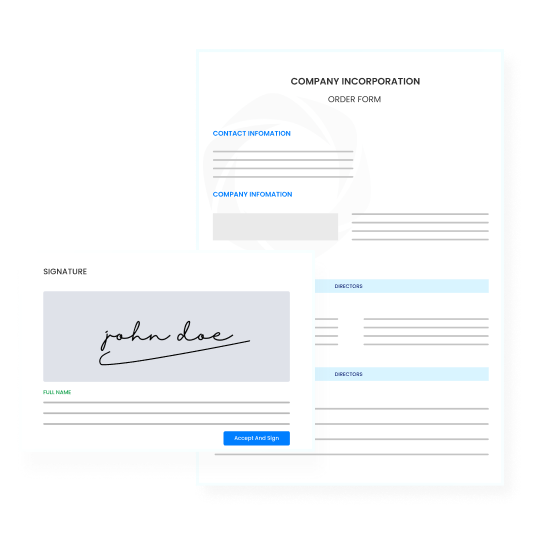

E-signature

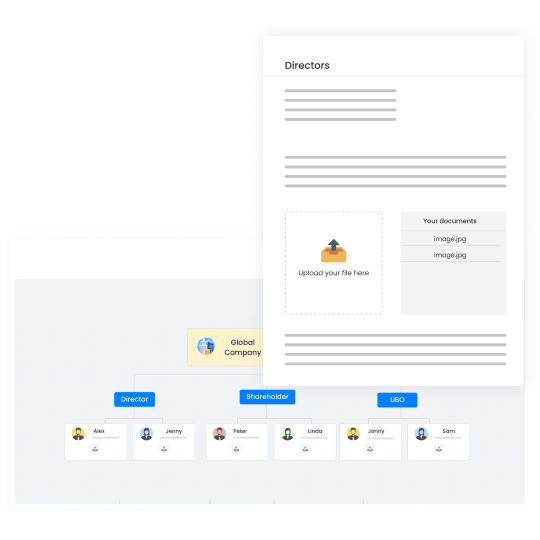

Digitized KYC

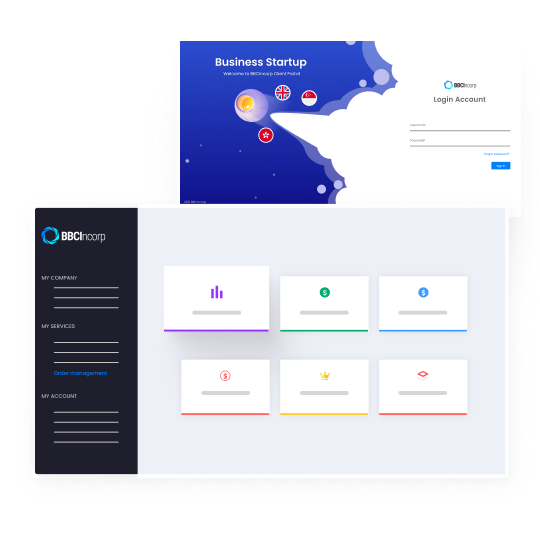

Centralized management portal

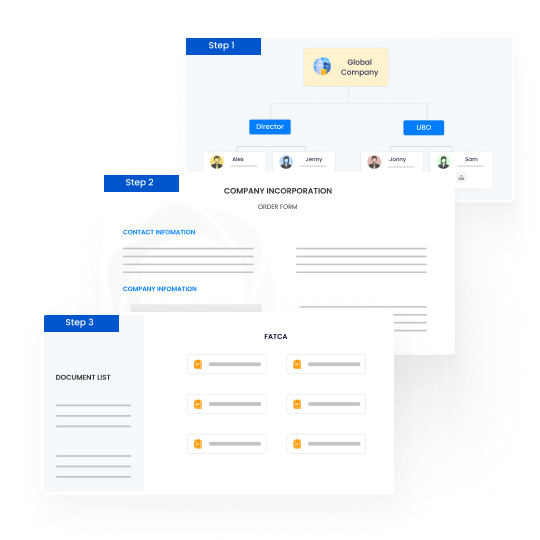

DelawareCompany Incorporation Process

Create your orders

Enter our online order platform for easy onboarding experience and tailor your orders. We have different packages and additional services that suit your goals. All information filled in is secured over 256-bit encrypted line.

Make payment

You can settle payment for services via flexible payment options including debit/credit card of Visa, Master, Amex or Bank Transfer. After you complete payments, we will provide you a checklist of required information for Delaware company registration.

Collect and verify KYC documents

Once we've received your payment, our customer service will contact you to process the necessary paperwork. We'll guide you to properly prepare documents for incorporation in Delaware via KYC online form. You can also access our digital Client Portal to proceed with the incorporation steps and keep track of the process anytime, anywhere.

Finish the company registration

The electronic documents are ready after 2 working days of company formation, and it takes 3-7 days for courier the original kit.

Required Documents

Notarized / Certified true copy of passports of all company members

Notarized / Certified true copy of address proofs of all company members i.e. identity card, bank statement, driving license, utility bill

We also provide true copy certification service for your personal identity documents as per your need.

* See certified true copy guide

Need more help to set up your business in Delaware

Just get in touch with us. We typically response within 2 hrs.

Frequently Asked Questions

Does a Delaware LLC need to pay the state corporate income tax?

No. There is no state corporate tax for income generated from outside Delaware.

In addition, there will be no state tax, local sales tax, or tax on interest, royalty and other similar taxes applied on a Delaware offshore LLC.

Which business lines need licenses to incorporate in Delaware?

Your business lines would be required to obtain certain licenses and permits from state agencies, federal agencies, or even both, to legally incorporate in Delaware.

Examples of such business activities: agriculture, alcohol, automobile, aviation, transportation, banking, child care, consumer protection, building/constructions, health, lottery, manufacturing, special events, and so on.

What are compliance requirements for an LLC in Delaware?

Following your successful Delaware company incorporation, keep in mind compliance requirements to keep your company in good standing. They are:

- All companies in Delaware must maintain their registered agent to sustain a local address and enlist the service of process.

- LLCs and LPs registered in Delaware must pay an annual tax (franchise tax) of $300.00. Due date for annual taxes in Delaware typically falls on or before 1st June.

- There is no requirement for a Delaware LLC to file an annual report.

Is a registered agent required when forming a company in Delaware?

Yes. Having and retaining a registered agent in the State of Delaware is mandatory to all business entities.

Note that the registered agent is required to have a local physical address in the state.

Is my company information in Delaware kept confidential?

Yes. Delaware laws provide companies registered in the State with a high level of privacy. This means all relevant identities and personal details of privately held corporate business owners are not made publicly available. Names, addresses of Delaware LLC’s members and managers are kept undisclosed as well.

Do I need a business license to sell online in Delaware?

Yes, acquiring a business license is essential for every business operating in the state of Delaware. Online businesses may only be required to obtain the Delaware state business license because Delaware has no sales tax. If you also need a local license for your online business, check with your city or county.

Do I need a business bank account for Amazon FBA?

While it is not required, there are several benefits to doing so. A Delaware business bank account helps with organization and record-keeping for your business expenses and income, it can also provide added credibility when working with potential partners or investors, and so on.

Do I need a business license to sell on Etsy in Delaware?

In Delaware, it is required to have a business license if you are conducting any type of business activity, including selling on Etsy.