Economic substance legislation has been introduced on many offshore jurisdictions worldwide as a signal for responding to EU and OECD initiatives in curbing harmful tax approaches. A prestigious financial offshore center like BVI does not lie outside such implementation.

In this article, BBCIncorp offers you a comprehensive guide to BVI Economic Substance Requirements that you should know.

Reminder of BVI Economic Substance filing deadline 2023

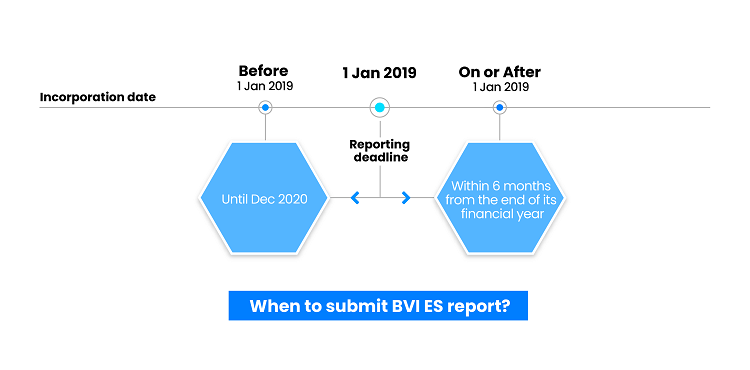

In-scope companies and partnerships in BVI must submit an annual economic substance report within 6 months from the financial year-end (FYE).

The table below outlines the upcoming deadlines for a selection of FYE:

| Financial year-end | Report filing deadlines |

| 31 Dec 2022 | 30 Jun 2023 |

| 31 Mar 2023 | 30 Sep 203 |

| 30 Jun 2023 | 29 Dec 2023 |

| 31 Dec 2023 | 30 Jun 2024 |

Overview of BVI Economic Substance Act (BVI ESA)

Economic Substance is the center of attention to any “no or only nominal tax” offshore jurisdiction, including the British Virgin Islands.

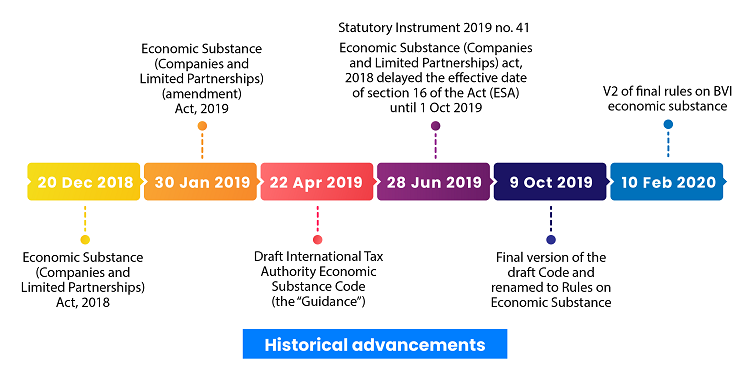

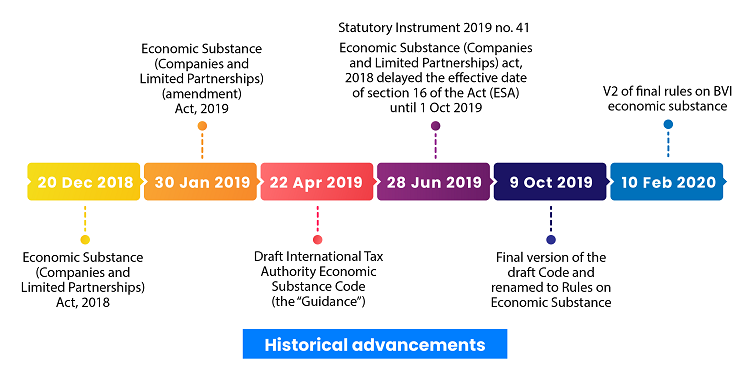

In reaction to commitment to adherence to the EU listing process and OECD BEPS Inclusive Framework, BVI has issued the Economic Substance (Companies and Limited Partnerships) Act, 2018. The regime officially came into force on 1st January 2019.

The final Code on BVI economic substance as the renamed Rules (and Explanatory Notes) on Economic Substance (the Rules) was released by the International Tax Authority (the ITA) on 9 October 2019. The updated version of the final rule was then published in February 2020.

It specified some adjustments set out by the Code of Conduct Group, as well as clarified further details regarding the reporting requirement and submission period under the BVI ESA.

You can find the original version of the final rules here.

Updates on amendments to BVI ESA

On 30 January 2019, some amendments were ratified to the Act (the “Economic Substance Act”).

On 22 April 2019, the draft International Tax Authority Economic Substance Code (the “Guidance”) was introduced with several supplements to the previous version of the Economic Substance Act.

On 29 June 2021, the Economic Substance (Companies and Limited Partnerships) (Amendment) Act 2021 has officially come into force. This is after some amendments were made to the Economic Substance (Companies and Limited Partnerships) Act, 2018 (ESA).

The key points are related to the limited partnerships without legal personality and clarification that “investment fund business” is not considered a relevant activity.

The update ensures that all BVI limited partnerships (with or without legal personality) are now considered a “legal entity”. Therefore, they now fall within the scope of the Economic Substance Regulations.

All registered BVI limited partnerships are subject to the compliance requirements and reporting obligations of the BVI Economic Substance.

The BVI Economic Substance Amendment Act 2021 adds definitions of “investment fund” and expressly excludes Investment Fund Business from being a relevant activity within the scope of BVI ES Regulations.

BVI legal entities that carry on relevant activities are within the scope of BVI Economic Substance rules.

What is a “legal entity”?

Pursuant to the Amendment Act 2021, the “legal entity” refers to

- all registered BVI business companies and foreign companies; and

- all registered BVI limited partnerships and foreign limited partnerships (with or without a separate legal personality)

An entity is considered to be out-of-scope of the ‘legal entity’ definition if it is a non-resident company. To be considered non-resident, a company must satisfy the two conditions below:

- it’s a tax resident of a country other than BVI, and

- that country is not included in the EU non-co-operative list.

What is a “relevant activity”?

Under the context of the economic substance regime, the OECD and EU demonstrate nine geographically mobile “relevant activities” which cover various ranges of business sectors. They include:

- Banking

- Insurance

- Fund management

- Finance and leasing

- Headquarters

- Shipping

- Holding company

- Intellectual property

- Distribution and service centers

What if you’re a within-the-scope entity?

As regulated by the final rule of this law, when a legal entity carries on a relevant activity, that entity must be subject to the economic substance compliance and reporting requirements with respect to that relevant activity.

In what follows, we will delve into what you need to do to comply with the BVI economic substance regime!

Compliance duties under BVI Economic Substance

Under the BVI Economic Substance Act, all BVI companies and limited partnerships, including BVI business companies with legal personalities engaging in one or more relevant activities must fulfill the Economic Substance requirements in relation to that activity.

Be advised that depending on your type of business entity and business category, the requirements can also vary.

For legal entity that carries on relevant activity (except for pure equity holding entity)

BVI legal entities (excluding pure equity holding company BVI) comply with the Economic Substance test if the following conditions are met:

- Direction and management test

The entity must guarantee that its relevant activities are directed and controlled inside the territory of BVI during its financial period.

This condition is related to the entity’s expenditure, number of employees, premises, and equipment located in BVI. In particular, the entity must guarantee:

(1) Having an adequate number of qualified employees to conduct the relevant activity in the BVI;

(2) Incurring sufficient operational expenses for the relevant activity in the BVI;

(3) Having an appropriate physical presence for conducting its core income-generating activities;

(4) In case the entity is engaging in IP business in which specific equipment will be used, that equipment must be situated within the BVI.

- Core Income-Generating Activities (CIGA) test

CIGA refers to central activities that are important to a relevant entity in terms of generating relevant income. The entity must conduct certain CIGA in the BVI, which are defined under section 7 of the Act and vary according to types of businesses.

The given table shows some typical CIGAs in relation to the nine relevant activities under BVI ESA.

| Relevant activities | Core Income Generating Activities |

| Banking business | Raising funds, managing credit or currency risks, providing loans and credit, managing regulatory capital, etc. |

| Insurance business | Predicting and calculating risk, insuring or re-insuring against risk, and providing business services on insurance. |

| Fund management business | Making decisions on holding and sales of investments, calculating risks and reserves, taking decisions on currency, etc. |

| Finance and leasing business | Agreeing on funding terms, identifying and acquiring leased assets, revising related agreements, etc. |

| Headquarters business | Making management decisions, incurring costs on behalf of affiliates, and coordinating group activities. |

| Pure equity holding business | Earning dividends and capital gains |

| Shipping business | Hiring and managing crew members, hauling and maintaining ships, scheduling voyages, etc. |

| Intellectual property business | Concerning intellectual property assets (patents, R&D) or non-trade intangible assets (brand, trademark and customer data, branding and distribution). |

| Distribution and service center business | Transporting and storing items, managing stocks, taking orders, providing consulting solutions |

For pure equity holding company

Section 8 (2) of the BVI Economic Substance Act defined a pure equity holding company as an entity that “carries on no relevant activity other than holding equity participations in other entities and earning dividends and capital gains”.

A BVI pure equity holding company is subject to a reduced economic substance test under the Act. Particularly, it must comply with the following requirements:

- It complies with relevant regulations under which it is governed – i.e. BVI Business Companies Act, 2004 or the Limited Partnership Act, 2017; and

- It has adequate premises and employees in BVI for passively holding or actively managing equity participation.

For intellectual property (IP) holding company

An IP holding company is presumed to not conduct core income-generating activity if activities carried on within BVI don’t include activities specified in section 7 of the Act. To rebut the presumption, it must prove that its activities within BV include:

- Strategic decisions and management of the principal risks pertaining to the development and exploitation of intangible assets;

- Strategic decisions and management of the principal risks pertaining to acquisition by third parties and exploitation of intangible assets;

- Underlying trading activities of intangible asset exploitation and income generation from third parties.

These requirements must be met at the time the entity seeks to rebut the presumptions, as well as during any historical periods during which the entity conducted intellectual property business.

For high-risk IP legal entity

The presumption can be contested if it can show the activities of development, exploitation, maintenance, enhancement, and protection of intangible assets are performed by suitably qualified employees who are on long-term contracts and physically present in the BVI.

Reporting obligations under BVI Economic Substance

Legal entities are required to fulfill reporting obligations yearly, such reports must be processed via their registered agent located in the British Virgin Islands. The documents required for your report may vary according to your business category and tax residency status.

Below is our list of classifications for reporting obligations:

| Entity | Required documents | Submission Date |

| Legal entities being BVI tax residents and conducting relevant activities | - Total revenue earned by the relevant activity in BVI;

- The entire operation spending on and by the relevant activity in BVI;

- The sum of qualified employees engaging in relevant activity in BVI;

- Address of premises in BVI in relation to the relevant activity;

- Details of equipment in BVI in relation to the relevant activity;

- Specifics of individuals in charge of direction and management of the relevant activity, and whether they are residents in BVI;

- Information on the outsourcing entity and deployed resources (if CIGAs are outsourced to another company).

| Within 6 months of the end of their financial period (or 18 months from the commencement of the financial period from 30 June 2019) * *Further details on the reporting timeline are mentioned in the below section |

| IP holding business | - The above-mentioned information is required;

- Whether they are high-risk IP businesses;

- Whether they want to contest the rebuttable presumption as prescribed in the Act (plus related documents)

|

| Legal entities conducting relevant activities, and NOT tax residents in BVI | - Details and support evidence regarding your tax residency country

|

Legal entities NOT engaging in any relevant activity regulated under BVI ESA must deliver a notification to their registered agent in BVI. The good news is that there is no need to provide further supporting evidence in this case.

In event of non-compliance, the ITA will issue a notice to the entity in question to inform them of the penalty details as follows:

- The reason for the designation of non-compliance

- The imposed penalty amount

- The due date for payment; and

- The resolution that the entity must take to align with the economic substance provisions and the date when the action must be taken.

Exchanging economic substance details can be conducted by the ITA to the overseas tax authority of one non-resident entity in BVI if that entity falls into the following circumstances:

- The entity has violated the economic substance rules in BVI, or

- The entity engages in IP business and falls in the presumption of not carrying out CICA within BVI.

If your company is proven to be a non-tax resident in the BVI then the International Tax Authority (ITA) will then notify the overseas competent tax authority located in the foreign jurisdiction.

As for the case in which your company has one beneficial owner being an EU member state, the ITA will also deliver a notification on the tax residency claim of your company to the corresponding authority in that EU member state.

Compliance timeline

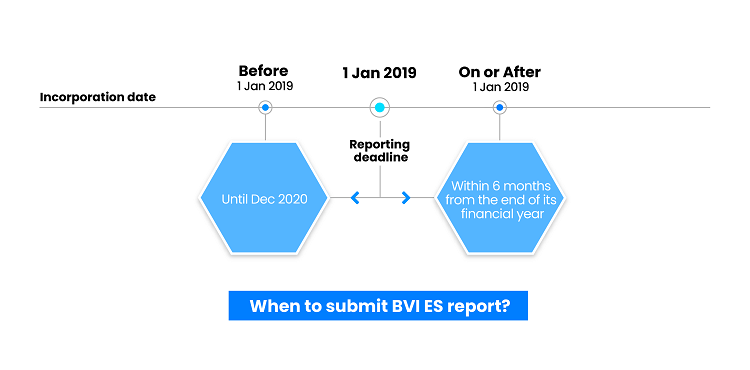

The ESA regulated that a legal entity must comply with economic substance requirements for any financial period in which it carried out relevant activities.

Regardless of engaging in relevant activities or not, all legal entities must submit an annual economic substance report within 6 months from the end of their financial year.

Financial period

The financial period of the legal entity can be determined in the following cases:

- For companies and limited partnerships (with legal personality) incorporated on or after 1 Jan 2019, the financial period is within 1 year from the date of incorporation.

- For companies and limited partnerships (with legal personality) incorporated before 1 Jan 2019, the financial period will start no later than 30 Jun 2019. In other words, such entities don’t have to comply with substance regulations until 30 Jun 2019.

The financial period of the BVI limited partnerships without legal personality has been updated as the following:

- For BVI limited partnerships without legal personality formed before 1 July 2021, their first “financial period” must commence no later than 1 January 2022.

- For BVI limited partnerships without legal personality formed on or after 1 July 2021, their first “financial period” will commence on its date of formation or registration.

Provisional treatment

For legal entities that need more time to supply the evidence within the period fixed by regulations for submission of information in respect of that financial period, the entity may apply to be treated as a provisional tax resident in a jurisdiction outside the BVI, pending submission of the evidence required to establish that fact.

The ITA may grant this treatment if the following conditions are met:

- The entity is able to prove its tax residency status in the previous financial period to be unchanged.

- The entity is able to provide the most recent evidence of its tax residence in that jurisdiction.

- Newly established entities that are still too early into their financial period for it to have documented proof of tax residency can provide other means to verify their tax residence for that period.

Evidence in support of the above conditions must be supplied within the filing period, which includes the following:

- A letter of the certificate that confirms the legal entity’s tax residency status in the foreign jurisdiction where it resides

- A tax assessment

- A confirmation letter of the entity’s self-assessment tax return

- A tax demand

- Proof of tax payment ( check, bank/credit card payment, etc.)

- Other issued documents by the foreign entity’s competent authority

Where such an application is made, the ITA must specify a reasonable period within which the necessary evidence is to be submitted (“the provisional extension period).

Conclusion

Any failure in compliance with BVI economic substance requirements will result in a financial penalty or even the strike-off of the entity. It is advisable that all companies in existence or to be newly incorporated in BVI be fully aware of the requirements as well as the submission timeline.

If you need help with incorporating your company in the British Virgin Islands, we offer a variety of BVI incorporation packages to fit all your incorporation needs.

Alternatively, if you wish to know if your company falls under the scope of BVI’s economic substance regime? Feel free to get in touch with BBCIncorp and our team will assist you!