A Delaware LLC merger is a process of combining two or more LLCs into a single entity. This can be done for a variety of reasons, such as to streamline operations, consolidate assets, or to reduce costs. If you’re considering merging your Delaware LLC, there are a few things you should know.

In this blog post, we’ll cover what a Delaware LLC merger is, why you might want to consider one, and how to go about merging two limited liability companies.

Overview of merger types in Delaware

A merger is a corporate action in which two companies combine to form one company. It occurs when one company purchases another company and the two companies combine their operations. Two common cases of merging companies are when a parent company acquires its subsidiary, or when a parent is merged into a subsidiary.

Title 8 of the Delaware Code prescribes that a Delaware company merger can be done either by filing a certificate of merger with the Delaware Secretary of State or stating in the company’s agreement of merger.

Short-form merger

If you’re considering a Delaware LLC merger, a short-form type may be the simplest and quickest option. It is commonly used in events that the acquiring company doesn’t want to hold meetings and have shareholders approved.

The short form is a type of “friendly” merger that can be used to combine two LLCs in Delaware. The state of Delaware also approved the consolidation of a Delaware non-corporate entity as the parent and a subsidiary in which the parent accounts for a minimum of 90% outstanding share per stock class.

In a Delaware corporation short-form merger, resolution of the board of directors shall be required. The statement must show that the parent company holding 90% owned subsidiary will be transferred to the status of no longer being a separate one. Depending on the case, you can be requested to clarify further details in the resolution for the merger.

In case the parent corporation is not the surviving corporation after the process, a vote of members at the meeting is required and can be completed in as little as 30 days.

Intermediate merger

The medium-form is also stated in Section 251(h) merger of the Delaware General Corporation Law (DGCL). An intermediate form enables Delaware corporation to acquire stocks without the approval of the stockholder. Delaware LLC cannot issue stocks, thus it can only become the acquiring party according to the applicable laws.

Long-form merger

If you’re considering a Delaware LLC merger (as the acquiring one), a long-form method may be the best option if you need approval from the members. The disadvantage is that the shareholders of the absorbed company will give up their equity in the old company and may have less say in how the new company is run. Long-form mergers may also lead to lengthy administration time.

Registered series merger

Section 18-210 of the Delaware Code allows the LLC registered series to enter a merger or consolidation with one or more registered series under the same LLC. This type is widely preferred than transferring assets and liabilities, the previously applicable method. Note that the merger process must be in compliance with the LLC agreement, or get through members who own over 50% of the interest in profits of every merging series.

Benefits of Delaware LLC merger

Merging two Delaware LLCs can have significant advantages for the members of both companies. A merger can create a larger and more powerful company, which can be more attractive to potential investors and partners. Additionally, a merged company can realize economies of scale and eliminate duplicative costs. It can also give the members of both companies greater control over the management and direction of the new company.

A merger is also a good way for the target company that’s on the verge of bankruptcy to allocate its liabilities and assets to the now-conjoined entity, consisting of itself and the acquiring company.

The surviving LLC in a merger takes on the rights and obligations of the other LLCs that are party to the merger. It can be used to consolidate multiple LLCs into one or simply change the ownership structure of an LLC.

Requirements and procedure for merging Delaware LLC

The Delaware LLC Act merger is a process whereby two Limited Liability Companies (LLCs) can merge together to form a new LLC under Delaware related laws. Accordingly, a Delaware LLC merger must receive the agreement of the majority of members holding more than 50% of the interest in the profits of the company.

One important note when embarking on a Delaware LLC merger is to make sure that both LLCs are in good standing with the state of Delaware. This means that they are up-to-date on all required filings and have paid any outstanding fees. They can ensure such status by obtaining a certificate of good standing in Delaware.

Obtaining Cover Memo and Delaware Certificate of Merger

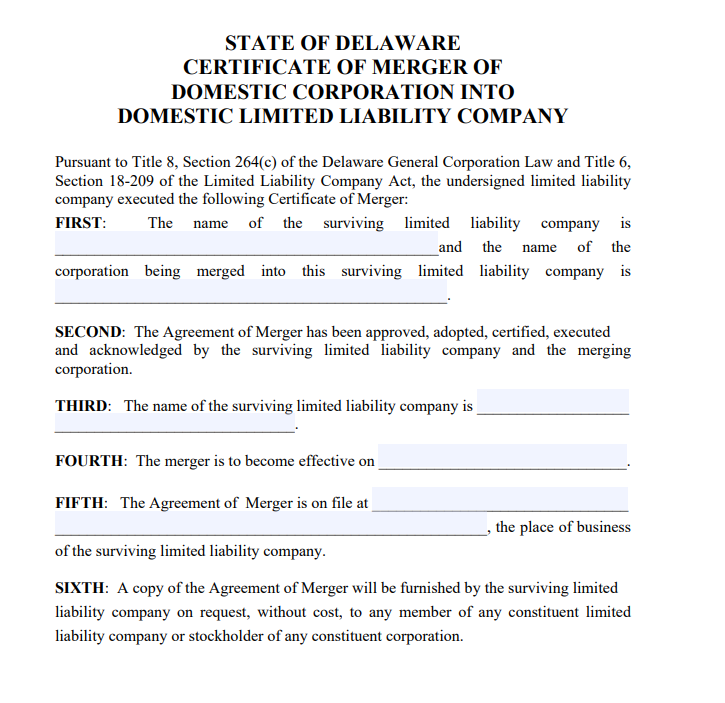

Limited liability companies will need to draft and sign a merger agreement, which will outline the terms of the merger and how the new LLC will be structured, and file certain paperwork with the state of Delaware in order to complete the process.

(Sample of agreement from Delaware corpfiles)

You must file Cover Memo and Delaware Certificate of Merger LLC with the Delaware Secretary of State. The certificate must include the following basic information:

- The name of the surviving company

- The name of the merged company

- A statement that the merger was approved by relevant parties

- The Agreement

- The effective date of merger

- A statement that the certificate was signed on behalf of each company by an authorized person

Once the certificate is filed, the merger is effective immediately. The surviving company then assumes all rights, powers, and obligations of the two companies that merged. Any property owned by the companies that merged also becomes property of the surviving company. Still, members and managers of the surviving company are the same as those of the two companies that merged.

Frequently Asked Questions

Who files Certificate of merger in Delaware?

The certificate of merger must be filed with the Delaware Secretary of State. The certificate must be signed by an authorized person from each merging company and must include sufficient information as requested.

Who needs to approve a merger in Delaware?

The members of each company must approve the merger. In addition, the Delaware Secretary of State must approve the merger.

Can a Delaware LLC merge into a Delaware corporation?

Yes, a Delaware LLC can merge into a Delaware corporation. The process is relatively simple and can be completed in a matter of weeks.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.