LLC and Corporation are the two most selected types of business entities in Delaware for non-residents. Still, many owners eyeing Delaware tend to wonder which one is better for their new business venture setup.

Below are key differences between Delaware LLC vs Corporation, which can help you to make rational decisions.

Certain attributes shared by both LLC and Corp in Delaware

When it comes to a comparison between an LLC and a Corporation in Delaware, the two most widely-chosen types of Delaware business structures for foreign startups, and entrepreneurs, you may first see some similarities.

- Member and shareholder’s liability

Both LLCs and corporations offer strong capability in terms of liability protection. The owner’s liability of a Delaware LLC, same as a Delaware corporation, shall be limited to the capital amount that he/she has contributed to the entity.

- Perpetual existence

Delaware LLCs and corporations have perpetual existence, meaning both two types shall not rely solely on their first shareholders or members. The company can still exist irrespective of members/shareholders in their business who may retire or no longer work in the company.

- Ownership

Another similar characteristic of LLCs and corporations in Delaware is that they can be owned by multiple owners. Shareholders in C corporations are not limited in number as per Delaware law, while a multi-member limited liability company in Delaware, as its name, has two members or above.

- Ease of setup

No less important, a straightforward formation process has become a privilege of choosing Delaware for setting up your company, regardless of a Delaware LLC or corporation.

Free ebook

All-in-one guideline to business formation in Delaware

- Explore Delaware business entities

- Discover incorporation process

- Understand Delaware tax system

- Learn about banking issues and other considerations

Delaware LLC vs Corporation: Key differences

In spite of some common features, there are key differences between Delaware LLC vs Corporation.

Is an LLC better than a corporation in Delaware? To be specific, an LLC is much more flexible in many facets; however, a Delaware C-corporation might be a preferred option for venture capitalists due to its consistency.

Below are some disparities between Delaware LLC vs C corporation that will help you to gain better insight.

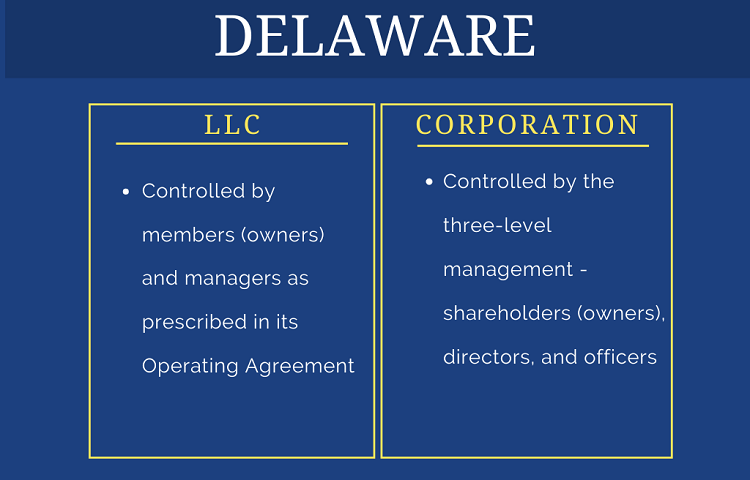

Corporate structure

A Delaware LLC is required to have at least one manager and members who are owners of the company.

With an LLC, an Operating Agreement is crucial as the structure, most formalities, and operating procedures of the company can be set out in it. This document is also considered one highlight that makes a Delaware LLC more flexible than a corporation.

If you choose to start your business with a Delaware corporation, bear in mind that it is a three-level bureaucracy. Three layers in its organizational structure include:

- Shareholders: who are owners of the corporation

- Board of Directors: which is selected by the shareholders

- Officers: who are arranged by the Board of Directors to follow its daily operations

The ability to raise capital

Stock is present in corporations. The ownership of Delaware corporations is shared through those stocks. And shareholders have the right to issue as well as sell stocks to raise capital.

Unlike Delaware corporations, there shall be no stock in a limited liability company. Typically, the company raises capital upon the amount of money that investors pour in the company.

Voting rights

To an LLC, you will find that the LLC Operating Agreement is a stand-out feature, and understand why it is highly recommended. The voting rights of LLC members can be specified in the Operating Agreement and are quite flexible. Also, any modifications can be made directly to the Agreement.

Delaware corporations, on the other hand, normally have only one class of stock. It is allowed to have additional classes that may be accompanied by various levels of voting rights; however, this addition must be well clarified in the Incorporation Certificate.

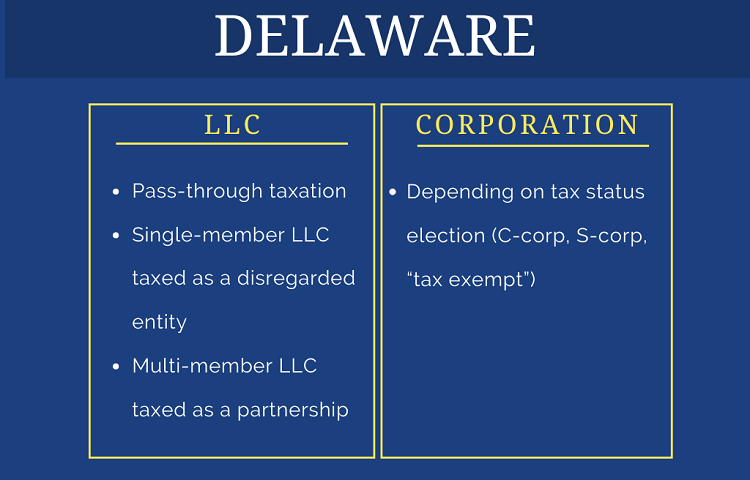

Delaware C Corp vs LLC – How their income is taxed

Tax is one of the key elements that may lead business owners to reach the final decision. In terms of taxation, a Delaware corporation also bears some differences in comparison with an LLC.

Delaware corporations can determine how they will be taxed through tax status elections. The default tax classification for a corporation in Delaware is the C corp status, if not elected as other statuses. C corporation is taxed at both corporate and individual levels. And such double taxation is regarded as the biggest drawback of C corp in most cases.

Taxed as an S corporation or “tax-exempt” status are two other options.

Note that S corporation status can only be selected by companies with no more than 100 shareholders and owned by US citizens only. The election to be an S corporation requires you to file with IRS Form 2253. Different from C-corp, one highlighted perk for choosing S-corp is the pass-through taxation, meaning only individual level (shareholders) is subject to tax in this entity.

Learn more about Delaware S-corp vs C-corp and the factors that differentiate them.

“Tax-exempt” status, as its name refers, grants corporations deductible advantage or even exemption from federal income tax. To qualify for such status, corporations, however, need to be transferred into exempt organizations such as charitable organizations, private foundations, or other non-profit entities. Form 1023 is the application form you need to submit in this case.

- Corporation: taxed as S-corp, C-corp, or tax-exempt. If not elected as Subchapter S status, C-corp status is the default

- LLC: A single-member LLC is a disregarded entity, while multi-member LLC taxed as a partnership

A Delaware LLC is a pass-through entity for tax purposes, similar to S-corp. So, income will be passed through the business (LLC is not taxed at the corporate level) directly to the members and taxed at their tax rate. Particularly, a single-member LLC and a multi-member LLC shall be taxed differently.

- Single-member Delaware LLC is taxed as a disregarded entity (sole proprietorship), while

- Multi-member Delaware LLC is levied as a partnership

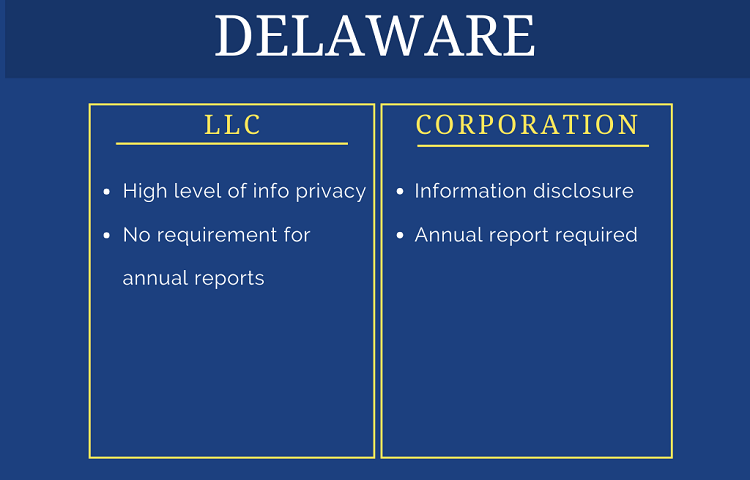

Privacy and other compliance requirements

Regarding the level of privacy, a limited liability company registered in Delaware will be a wise choice.

There is a better privacy guarantee since the identity details of LLC members are NOT required to be disclosed in most cases. There is also no annual report, no meetings, and minutes required for Delaware LLCs.

By way of contrast, corporations in Delaware are more likely to ensure consistency, which means they must follow strict requirements and provisions as per associated laws. Disclosure of directors’ or officers’ names, and addresses is one of those requirements. And filing an annual report is also a compulsory duty for Delaware corporations.

To learn more about other types of business entities in Delaware, refer to our related article.

Delaware LLC vs Corp – which one suits your business, especially for non-US residents?

It may be a tough question. In fact, both are the most popular types of entities in Delaware with distinct features. Still, for startups and small businesses, Delaware LLC formation seems to outweigh corporations in many aspects – lower tax burden, privacy guarantee, or simple maintenance requirements. Delaware corporations, with toward-consistency features and stock ownership, tend to be a good option for venture capitalists.

Looking to start your business venture in Delaware but uncertain about which to incorporate – LLC vs Corporation? Check out our Delaware company formation service or simply talk to one of our friendly consultants to get practical advice!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.