Offshore bank accounts have always been familiar to entrepreneurs as a way to manage business finances. In this article, we look at one of its specific types – an offshore brokerage account.

Take your time to read on to discover everything you should know about this type of account.

Overview of an offshore brokerage account

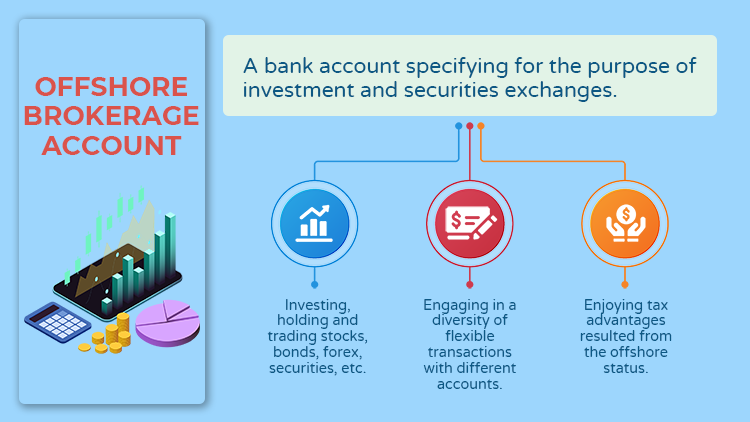

A brokerage account is a bank account specifying for investment and securities exchanges. An offshore brokerage account refers to a brokerage account to be opened in a jurisdiction outside of your original country.

In general, you open a brokerage account with a brokerage firm.

Once you have deposited the fund into this account, regardless of cash or credit source, you can start trading and exchanging various types of investment securities as you want.

There are various purposes for the offshore brokerage account. But in specific, you can use it for the following common intentions:

- Investing, holding, and trading stocks, bonds, forex, securities, or other financial instruments;

- Engaging in a diversity of flexible transactions with different accounts;

- Enjoying tax advantages resulting from the offshore status;

Also, in most cases, an offshore brokerage account is owned by a company, not by an individual.

Offshore vs Domestic brokerage account

You may be confused about how the offshore brokerage account is different from the domestic account.

In this section, we help you clarify some general differences between offshore and domestic brokerage accounts below:

Offshore brokerage account

- High minimum threshold

- Flexible financial instruments and extensive access to investments

- Multiple foreign currencies are allowed

- Beneficial taxation and open regulatory framework

- High possibility of risk

Domestic brokerage account

- Low minimum threshold

- Limited financial instruments and access to investments

- Multiple foreign currencies are not allowed (in some cases) and no tax benefits

- Strict regulatory framework

- Low risk

See your chance of getting your desired business bank account with easy steps!

![]() List of

recommended banking options

List of

recommended banking options

![]() Successful rate

assessment on your choice list

Successful rate

assessment on your choice list

Countries for offshore brokerage account

More often than not, an offshore brokerage account is preferred by those in need of opening a bank account for financial investment purposes.

Interestingly, many foreign investors choose to open an offshore bank account to facilitate easier access to their offshore brokerage accounts.

To gain more insights into which offshore banking country you should consider, simply read our article on Countries with best offshore bank accounts.

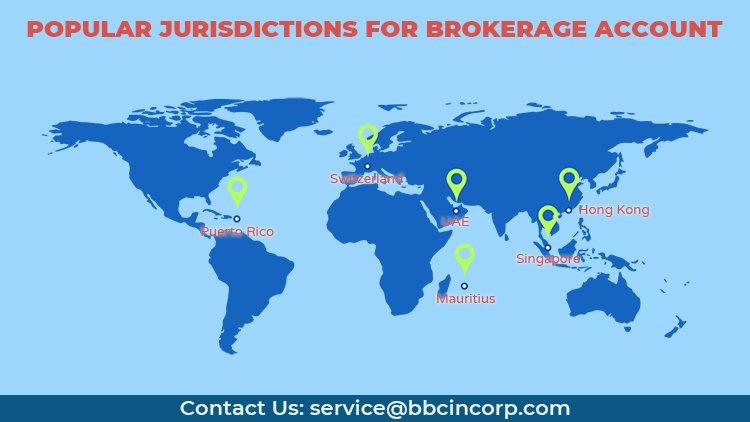

The question is where should you set up your oversea brokerage account?

Depending on your circumstance and your chosen offshore bank, you may capture different advantages as well as investment opportunities.

To summarize, popular jurisdictions for setting up an offshore brokerage bank account are Switzerland, UAE, Mauritius, Singapore, and Hong Kong.

Key note

Assuming you have an e-commerce company and your profits are mostly served for other investments like purchasing stocks, then Mauritius can be a great option to open your brokerage account.

Each offshore locale can be tied closely to different features that make it stand out, so it is advisable that you spend time checking your choice before moving.

Offshore brokerage account: Benefits and Drawbacks

There are both pros and cons to opening an offshore brokerage account:

Benefits

- Flexibility

You can make investments and earn returns at any time and anywhere across the world.

In addition, you’ll have a variety of investment options, unlike domestic accounts. For example stock, bonds, futures, forex, exchange-traded funds, mutual funds, etc.

- Tax benefits

An offshore brokerage account allows tax savings and many supportive tax incentives for your businesses, especially in respect of capital gains tax exemption.

- Asset protection

You may face volatile regulatory circumstances in your domestic country. This may increase the risk for your funds.

But with offshore accounts in stable jurisdictions like Hong Kong, Singapore, Belize, and the BVI, your assets will be safe and secured.

- Privacy

As an account holder, you would expect your information to be confidential and private.

Most offshore laws set out strict corporate and banking confidentiality frameworks to ensure privacy protection for account holders.

Furthermore, you’ll have unlimited access to international markets, diversifying investment opportunities, or no condition of income.

To get a good understanding of offshore bank accounts, simply check out our article on the 8 benefits of offshore bank accounts that you must read.

Drawbacks

- Opening cost

The cost of opening a brokerage account may be more expensive than that for domestic accounts.

Depending on your chosen jurisdiction and broker, the fee to open your account can be varied.

- Initial deposit

Each broker has different sets of requirements. Some online brokerage may allow you to start the investment account without an initial deposit, or at a minimal cost.

Some, on the other hand, may require minimum investments ranging from $100,000 to $1 million.

- Financial risks

Using a margin account (explained in section 5.2) may cause potential risks for your offshore brokerage account.

In addition, the inappropriate usage of offshore brokerage accounts can unexpectedly lead you to a financial crisis.

- Legality concerns

Offshore investment has emerged for a long time, with both positive and negative records.

Whether this type of account is legal, moral, or safe has aroused the interest of the business world.

Due to some cases of tax evasion by shifting offshore, many countries, especially in the United States and Europe, are tightening their tax laws.

To gain relevant knowledge on taxation before using your offshore brokerage account, read our comprehensive guidelines on Tax evasion, Tax avoidance, and Tax planning.

Anyway, if you’re opening an offshore investment with a legal brokerage account, and there is nothing wrong with your compliance, then you should feel secure. However, tax laws may be a bit more complicated to handle.

In reality, do choose a reputed offshore jurisdiction to handle your assets, plus be in compliance and well-prepared (like proper due diligence is always in need). Then you can feel free to move ahead and utilize offshore brokerage accounts to advantage of your investment opportunities.

Want an offshore brokerage account to kickstart your business? Simply get in touch with us via service@bbcincorp.com for actionable advice. Our banking support is built around your needs, so you can get to your end objective in no time.

Types of offshore brokerage accounts

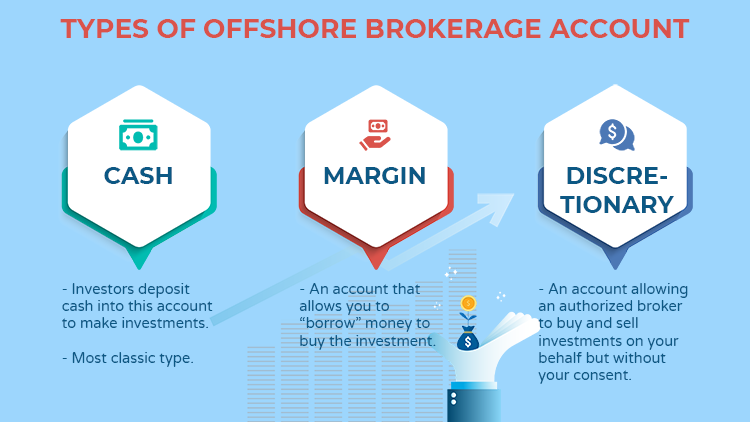

Overall, there are three types of brokerage accounts that you should know. They are:

- Cash account

- Margin account

- Discretionary account

In what follows, we will learn the key features of each type!

Cash account

To begin with, a cash brokerage account means you deposit cash into the account to make investments as well as enter transactions.

For example, if you want to buy a stock at the price of $3,000, you must have that full amount in your cash account to make the investment purchase.

Furthermore, in some cases, you also need to prepare the commissions to order the trade in advance.

In general, the cash account is the most classic type of brokerage account. Most brokers will automatically set out and register this type of brokerage account for you.

Whether you wish to upgrade your account to another type or not will be left to the brokers’ discretion.

Margin account

While a cash account only accepts cash and the brokerage firm will not lend you any money, a margin account is another approach.

With a margin account, the brokerage firm will allow you to “borrow” money to buy the investment you want.

For instance, if you open a margin account and want to buy the stock at the price of $3,000, you can place in your account the cash amount of $2,000 and borrow from the brokerage firm the remaining $1,000 to buy.

Although you can borrow the amount with low-interest rate loans and flexibly manage the trade settlement for your investment, there will be higher risks of losing money.

Consequently, the broker who lends you money will hold the right to sell your investments to cover the deficits without any acceptance from you, especially in the case that your own investment fails or decreases in value.

Discretionary account

Basically, a discretionary account is an account allowing an authorized broker to buy and sell investments on your behalf but without your consent.

It appears to be common that discretionary account is suitable for those with a large investment portfolio, but not self-directed investors.

We’ve summarized the key highlights of the above-mentioned brokerage accounts:

Cash account

- Must have full cash amount in the account

- Good for beginning investors

- Low-level risks

Margin account

- Just need a part of the cash amount in the account, the other can be “borrowed” from the broker

- Suitable for those seeking flexible trade settlements

Discretionary account

- The authorized broker will hold full right to decide the investment purchase of the account

- Fit for those with a large investment portfolio and who need to hire an advisor for management

The bottom line

In a nutshell, opening an offshore brokerage account has both benefits and drawbacks. So if you are looking for offshore investment via a brokerage account, you’ll need meticulous planning and financial preparation.

Additionally, to make the most of its benefits regarding the legality, tax implication, better asset protection, or international investment opportunities, you should choose a reputed offshore jurisdiction and brokerage firm to work with.

Please note that the information presented in this blog is for general use. If you as an investor are seriously putting opening an offshore brokerage account into consideration, please engage professional experts for practical advice on your circumstances.

Feel free to get in touch with us if you have questions concerning offshore brokerage accounts!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.