Starting a business in Singapore is simply one of the best decisions that you can make. The country has been listed as one of the top places to do business globally for a very long time.

As a foreigner, you need to register a company and open a bank account to kick-start your business in Singapore. Keep on reading as we will list down the step-by-step process of how to do so.

Benefits of starting a business in Singapore

According to the 2020 Ease of Doing Business rankings conducted by The World Bank, Singapore secured second place in the list of countries that are the easiest for doing business. The Lion City has impressively maintained the top ranking for many consecutive years.

Indeed, Singapore has attracted a great number of foreign entrepreneurs and businesses to come and invest, due to a wide range of advantages that the country can offer, including:

- Ease of company formation (you can open your Singapore company completely online and the process normally can be done within 24 hours)

- Favorable tax system (you can benefit from not only the low tax rates but also many beneficial schemes that can help your company legally lower the payable tax)

- Singapore’s strategic locations and its modern infrastructure system

- Highly-qualified workforce and great living standard

- Opening immigration policy

- Excellent intellectual property regime

How to start a business in Singapore as a foreigner

If you are a non-resident, there are 2 things that you need to do to quickly start a business in Singapore:

- Register a local company

- Open a corporate bank account

How to Set up a Company in Singapore

Here is the 6-step procedure to set up a company in Singapore for foreigners:

Step 1: Pick the type of business entity

There are many types of business entities in Singapore from which you can choose. Some of the most common ones are listed below:

- Sole proprietorship

- Limited liability company

- General partnership

- Limited partnership

- Limited liability partnership

If you are still wondering what type to choose, the advice is to go for a private limited company. It is a company that is owned by a maximum of 50 shareholders. In general, this type of company can bring you more benefits than other types of business:

- It is considered a separate legal entity.

- Its members have only limited liability. This means you, as a shareholder, will not hold any liability beyond your own share.

- It can be eligible for a tax exemption of 75% and other exclusive tax schemes and grants.

- You will not be taxed on dividends distributed from the company.

Step 2: Choose the name of your company

The next thing to do is name your company. Here are some guidelines for you:

- The name must be unique, meaning not the same or too identical to other existing ones.

- The name should not contain any offensive meaning or sensitive words.

- The name should not imply any connection with government agencies.

If your proposed name satisfies all the conditions, you are good to go!

Step 3: Use a service for Singapore company registration

If you are a foreigner and want to register a company in Singapore, you must engage in an incorporation service of professionals. This is a statement from the Accounting and Corporate Regulatory Authority (ACRA), the government agency that oversees all business registration in Singapore.

A service can easily help you cover all the incorporation requirements. In particular, to register a local company, you will need to fulfill the following:

- Having a director who locally stays in Singapore

- Having a local registered office address in Singapore

- Having a secretary within 6 months after the incorporation

- Having an auditor within 3 months after the incorporation

How can BBCIncorp help you?

If you’re a Singapore local startup, look no further than BBCIncorp’s Basic package! For just $675, this comprehensive incorporation bundle will provide all the basics necessary to ensure your venture gets off on the right foot.

Our Standard package ($1950) is specifically tailored for companies run by non-local investors and business owners. You’ll receive a nominee director, secretary, and local address with your purchase without having to do any of the tedious paperwork yourself. Plus we’ll handle all the necessary incorporation requirements on behalf of ACRA so that you don’t have to worry about missing a single step!

If you’re searching for a Singapore work pass application, consider our Premium package ($1985). You will not only get all the advantages of our standard offer but also an employment pass. We’ll assist you in applying for a work pass so that you can move to Singapore and take charge of your organization without delay.

Free support for bank account opening with Singapore banks is available in all three packages.

If your Singapore business is considered small (less than $10mil of annual revenue and no more than 50 employees), you don’t need to hire an auditor.

Please check out our Singapore company incorporation services for more details!

Step 4: Make a payment

If you decide to use our services, the next step is to pay for the chosen incorporation package. You can pay directly on our website via Paypal or Stripe or bank transfer. Once the payment is made, our staff will reach out to you for order confirmation on the same day.

Step 5: Follow the KYC procedure

Complying with the know-your-customer (KYC) procedure, our employees will ask you to supply some documents and information for the company registration. Here are what we need from you:

- The proposed name of your company

- The details of your company’s business activities

- Certified copies of all members and shareholders of the company

Once we get everything needed from you, we will proceed to file an application and submit it to ACRA.

Step 6: Get the result

You can expect to receive a digital certificate of incorporation in just 24 hours. However, the processing time may be extended to a few days if the government needs more time to process your application.

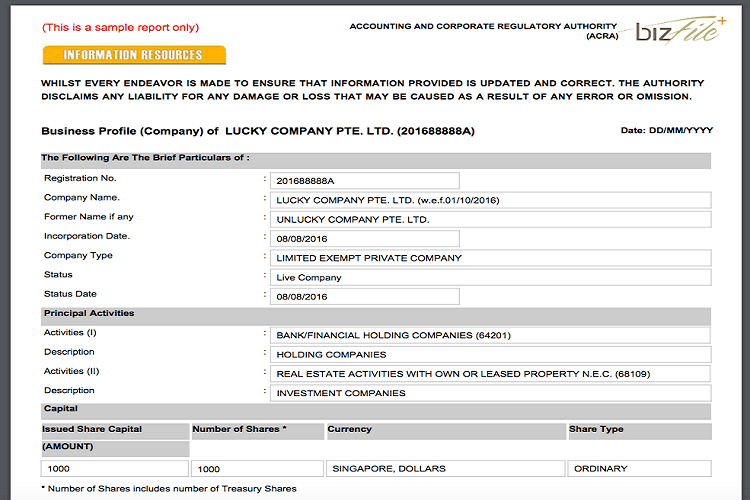

At this point, your new company will have been successfully formed in Singapore. You will receive an email, with a certificate of incorporation and a business profile attached. The profile includes essential information about your company.

How to apply for a bank account

To start a business in Singapore, you will need to further open a bank account. Your company needs one to transact with customers, partners, and even the government. It is also the best way to protect your personal assets since the company’s money is stored separately in its own account.

Singapore has one of the world’s best banking systems, with many large and reputable banks. A corporate account with Singapore banks can greatly enhance your business image.

Although many banks’ application processes are quite similar, each bank has a different set of conditions for approval. If you are a foreigner, it is really hard for you to apply on your own. The advice is to go for a suitable banking service.

BBCIncorp can help you on this matter. We have successfully assisted many new companies in Singapore to open their corporate accounts. Here is the procedure to apply for a bank account if you work with us:

- Consult our staff to pick the most suitable bank and know about the application process

- Make a payment (if you place a separate order for our banking service)

- Supply certain required documents

- File and submit the application (we handle this step)

- Go on an interview with the bank if your application is approved (we will make an appointment for you)

For an application, you will need to provide us with the following:

- The corporate documents (the certificate of incorporation)

- The address proof (passports) of all the company’s members

- Bank reference letter and statements

- Business proof (business contracts, agreements, invoices, etc.)

If the interview finishes well, you can expect your corporate account to be opened in a couple of weeks. Please note that the decision is solely made by the bank. We can not guarantee a success rate of 100%.

Having your company and bank account opening is enough for you to begin your business in Singapore. If your company operates in certain activities that require additional licenses, you need to apply and obtain them before starting your business.

Some notes for running your business in Singapore

During the whole time of operation, your company generally needs to comply with the following basic requirements:

- Hold annual general meetings

- Pay corporate tax

- File annual returns with ACRA

- File tax returns with IRAS (the government agency for tax matters in Singapore)

- Maintain accounting records and the company’s register

- Register for Central Provident Fund if hiring local staff

- Register for Goods and Services Tax if needed

Your company runs small businesses, it can be exempted from many requirements when meeting certain conditions. For example, it can be eligible for the following exemptions:

Tax (partly)

- Annual general meeting

- Financial statement

- Audit

One more thing: you can become the sole director of your company in Singapore. This means that you do not need a nominee director. You can apply for an Employment Pass, obtain it, move to the city-state, and become the director of your company. Until that time, a nominee director is still in need.

ANNUAL COMPLIANCE

Gain more oversight into corporate compliance requirements of over 18 jurisdictions. Get your results now!

![]() Compact view of your company’s regulatory

requirements

Compact view of your company’s regulatory

requirements

![]() A quick breakdown of key reporting timelines

A quick breakdown of key reporting timelines

Conclusion

To answer the question of how to start a business in Singapore, you need to do 2 main things: register a company and open a bank account. Both of them can be done easily with the help of our services.

BBCIncorp is also providing you with a comprehensive set of incorporation services. We take care of almost everything for you to set up a business in Singapore.

We offer consultancy for free! Our experienced employees advise on your particular needs and situations. Talk to us now!

Frequently Asked Questions

How much does it cost to start a business in Singapore?

To begin your business in Singapore, you will need to open a company and a corporate account. Our Standard package for incorporation will cover you on both matters. The fee for such package is $1,950.

Can a foreigner open a company in Singapore?

Yes, they can. A company in Singapore is allowed to be 100% owned by foreigners. However, to set up a local company, foreigners need to do it through licensed services.

How can I start a small business in Singapore?

You can quickly form a business in Singapore by taking the following steps:

- Pick the type of company you want

- Choose the company name

- Use a service for company setup

- Make a payment for the service

- Supply the required information

- Get your company’s certificate of incorporation

- Apply for a bank account

- Start your business

Is it easy to start a business in Singapore?

Yes, it is, with the help of our professional services. We will take care of almost everything for you. All you need to do is provide us with necessary documents.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.