The BVI is widely known for having a “best-in-class” approach for confidential reporting of beneficial ownership information to authorities, and the Beneficial Ownership Secure Search System (BOSS Act) is the jurisdiction’s cornerstone law in this regard. Check out our below text lines for more information.

An introduction to the BVI BOSS Act

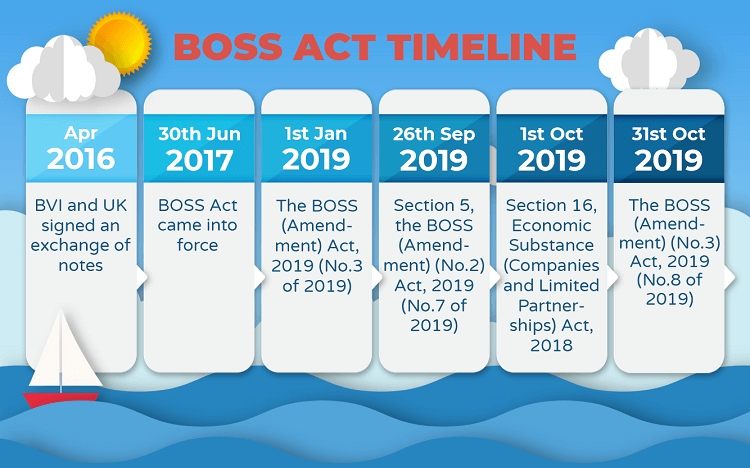

The Beneficial Ownership Secure Search System Act, 2017 (BVI “BOSS Act”) took effect on 30 June 2017 and was amended several times.

The Act makes it easier for all BVI firms and legal entities to store and retrieve beneficial ownership information by utilizing the Beneficial Ownership Secure Search system. In fact, it’s a centrally managed system of the BVI competent authority to provide access to prescribed information of relevant legal entities maintained by registered agents (RA).

Initially, the law’s purpose was to enhance the efficiency of information exchanges in relation to the notes between the country and other authorities. The Act has been modified several times to better align with the information demand laid out by Economic Substance legislation.

Amendments to the BOSS Act

Since 2019, the BOSS Act has developed to include economic substance information reporting as part of the Economic Substance (Companies and Limited Partnership) Act 2018.

It was revised twice in 2021 by two Amendment Acts.

The first amendment, which went into effect on July 1, 2021, included two important changes:

- Limited partnerships without legal personality are added as a qualifying reporting entity; and

- “Investment fund business” is clarified as not a relevant activity needing economic substance.

In detail, every limited partnership that (a) is regarded as a resident entity within the British Virgin Islands and (b) is carrying out a relevant activity must be “directed and managed” in the British Virgin Islands and carry out “core income-generating activities” there.

They must also assure strict conformity to the Act’s specified standards of “adequacy” and “appropriateness.”

As a result of this modification, limited partnerships created before July 1, 2021, will have a 6-month transitional period, allowing them to be in compliance no later than January 1, 2022.

Limited partnerships formed on or after July 1st, on the other hand, must comply with the new modification immediately.

The second amendment in 2021 took effect on 1 January 2022 and applies to ES “financial periods” (FPs) beginning on or after that date.

Knowing your company’s compliance status with the BVI Economic Substance legislation is critical to defining your reporting requirements as a business owner. Use our BVI Economic Substance Self-Assessment Tool to see if your organization is subject to these criteria.

Legal entities subject to the Act

Legal entity definition

The Beneficial Owner Secure Search System Act, 2017 defined legal entities as all registered BVI companies under the BVI Companies Act, 2004, and any limited partnership which has legal personality in the BVI.

The Act requires legal entities subject to its provision to provide information of beneficial owners and registrable legal entities to the BOSS system via Registered Agent (RA). To clarify, you need to be familiar with the following terms:

A beneficial owner is any person who obtains benefits of the ownership and “ultimately owns or controls” the legal entity. Beneficial owners must also satisfy conditions in the following cases:

- A natural person who ultimately owns or controls, whether directly or indirectly, 25% or more of the shares or voting rights in the legal person (in the case of a legal person other than corporate and legal entities with securities listed on the stock exchange);

- A natural person who otherwise exercises control over the management of the legal person (in the case of a legal person);

- A partner controlling the partnership, a trustee, a settlor, or other persons acting a similar function in controlling or making the legal arrangement (in the case of legal arrangement);

- A natural person who is designated as liquidator, administrator, or administrative receiver of the entity (in the case of the corporate and legal entity in insolvent liquidation, administration, or administrative receivership under the BVI Insolvency Act, 2003);

- A creditor appointing the receiver no less than 25% of the shares or voting rights in the corporate and legal entity;

- A natural person who is an executor or representative of the deceased’s estate (in the case of a shareholder who would otherwise be a beneficial owner but is deceased);

- A joint owner in the CLE with two or more persons having qualifying interest jointly.

According to the BOSS Act (2017), a registrable legal entity refers to an entity that:

- Is the beneficial owner of the corporate and legal entity if it were an individual; and

- Is an exempt company; or

- Is a company having its securities listed on a known stock exchange; or

- Is a sovereign state or a 100% owned subsidiary of a sovereign state; or

- Is a licensee or foreign regulated person as prescribed under BVI Anti-Money Laundering Regulations 2008.

Duties of legal entity

You must adhere to the following reporting timelines for the beneficial owner and registrable legal entity information:

- Identify and notify your RA of beneficial owners and registrable legal entities within 15 days of identifying such persons or entities.

- Keep beneficial owner information up to date by notifying your RA of any changes in the information of BOs within 15 days of becoming aware of these changes.

As for information related to relevant activities, you have to notify your RA within 6 months of your financial year-end.

Reporting information under BVI BOSS Act

What are the required documents under the BVI BOSS Act? Subject to this regime, your BVI companies must file certain “prescribed information” to the Registered Agent (RA).

Prescribed information shall include:

- The company particulars

This must contain name, incorporation number, date of incorporation, status, registered address, information of the company’s stock exchange listing, whether the company is carrying on a relevant activity, and other supporting information contingent on your claim of tax residency.

Be advised that the information retained on the RA database by the Registered Agent must last for 5 years since the dissolution of the corporate and legal entity or from the date on which the entity ceased to be the CLE.

Further details on what you must file in relation to your claim of relevant activities under the BVI Economic Substance Act can be found in Section 7 (c) of BVI BOSS (Amendment) Act, 2019 (No. 8 of 2019).

- For beneficial owner information: name, date of birth, proof of nationality, and residential address;

- For registrable legal entity information: particulars of the registrable legal entity (as listed in The company particulars), the jurisdiction of incorporation, proof of the fact that the entity is appointed as a registrable legal entity, and whether the entity in question is a foreign regulated person or a sovereign state, etc;

- For the parent of the corporate and legal entity: particulars and the jurisdictions of incorporation of the parent company;

Note that beneficial owners of corporate and legal entities subject to the BOSS Act, 2017 would not include “exempt persons”. In particular, exempt persons (stated in Section 7, BOSS Act, 2017) cover the following types of entities:

- The entity that is recognized, registered, or otherwise approved as a mutual fund under the BVI Securities and Investment Business Act, 2010. They consist of an approved, incubator, public, private or professional fund;

- The entity whose securities are listed on a recognized stock exchange;

- The entity that is a subsidiary of another entity falling into the two exemptions listed above; or

- The entity is a BVI licensee under the Regulatory Code, 2009.

Unlike the in-scope CLEs as above mentioned, those entities with exemption do not need to submit the information of their company’s beneficial owners. The sole requirement is to report whether their business is carrying on nine relevant activities under the BVI Economic Substance Act.

Along with the other UK Crown Dependencies and Overseas Territories, the BVI has committed to working with the UK government to establish a publicly accessible register of beneficial ownership for companies.

This is consistent with international standards and practices, as well as the Member States’ implementation of the EU’s fifth Anti-Money Laundering Directive by 2023.

As a result, it is likely that beneficial ownership reporting will be an increasing focus of regulatory scrutiny in the future, and it is important for you to evaluate the existing obligations under the BOSS Act.

Learn more about the economic substance regime in the BVI with our 2023 updated guide to BVI Economic Substance Requirements

A quick look at BVI Beneficial Owner Secure Search System

For those who may be interested in the Registered Agent (RA) database and the BVI BOSS System, you can take further looks into our brief as the followings:

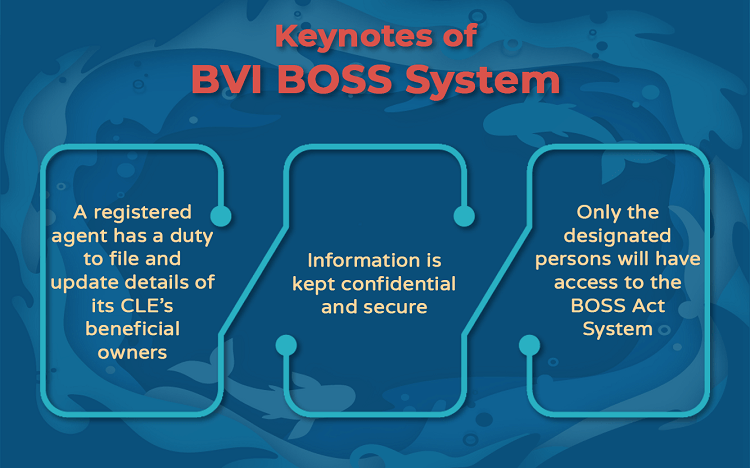

- A registered agent has a duty to file details of its CLE’s beneficial owners, and then update such information on the RA database connected to the BOSS system.

- Information on that database is NOT publicly disclosed but is kept confidential and secure.

- Only the designated persons will have access to the Beneficial Ownership Secure Search System. A designated person as stated must satisfy certain conditions before being approved to have access to the BOSS system. In particular, he/she must complete a security vetting test as well as participate in the commitment to confidentiality.

It should be noted that any breach of non-compliance by the designated persons pursuant to this law can lead to a financial penalty of up to US$75,000 or imprisonment for a period of up to 2 years or both.

Some authorities in the BVI can offer a request for searching for information via the BOSS System are:

- The Financial Investigation Agency;

- The Financial Services Commission;

- The International Tax Authority;

- The Attorney General’s Chambers.

Don’t hesitate to drop us an email via service@bbcincorp.com if you need further information about this matter.

Key Takeaways

Key considerations of the BOSS Act in 2022

The following are the major aspects to be aware of:

- Beneficial owner reporting for limited partnerships without legal personality

All limited partnerships without legal personality registered in the BVI (Relevant LPs) are now considered “corporate and legal entities” (Entities) and must submit mandated BO information to their registered agent within 15 days of detecting such matters from January 1, 2022.

- Exemption for investment funds and “exempt persons”

If the Relevant LP is an “exempt person” (as defined by the BOSS Act) who does not engage in any “relevant activity” under the ESA, the reporting obligation does not apply.

The vast majority of Relevant LPs are investment funds governed by the Securities and Investment Business Act of 2010, and so should continue to be exempt.

- ES reporting for financial periods

The scope of ES reporting information for FPs commencing on or after January 1, 2022, has significantly expanded.

Entities must identify and disclose specified information about any “immediate parent” and “ultimate parent” of the Entity as part of its ES reporting (which must be completed within six months of the end of the relevant FP).

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.