How To Set Up An Offshore Company is a detailed roadmap that supports every start-up or new offshore player to save their time and resources. Please read below!

The term “offshore company” has become too familiar to entrepreneurs, and the topics associated with offshore company often remains at the top level of attention.

Thanks to many benefits, namely tax optimization, asset protection, or privacy, a large number of business players have been increasingly flocking to offshore jurisdictions. For that, some common names gained in popularity include the British Virgin Islands (BVI), Belize, Hong Kong, and many more.

Some may feel easy to incorporate their offshore company. Some, on the other hand, have given feedback on the procedural requirements as well as the complicated process that they must deal with. Through many cases, what BBCIncorp realized is that the clients did not gain sufficient knowledge for the particular incorporation of offshore companies. In this blog, we will drive every start-up or new offshore player to everything they need for setting up an offshore company.

Don’t miss 3 must-do steps in the preparation stage

Good preparation always makes good results! Below are 3 important steps to prepare for incorporating your offshore company:

Understanding based knowledge about an offshore company and its relevant issues are needs. Then, it can fuel you minimize the potential of any wrong move. Likewise, it would really help if you can answer such questions like “how do offshore companies work?“, or “which offshore jurisdictions should you first put in your consideration list in respect of your business demand?”.

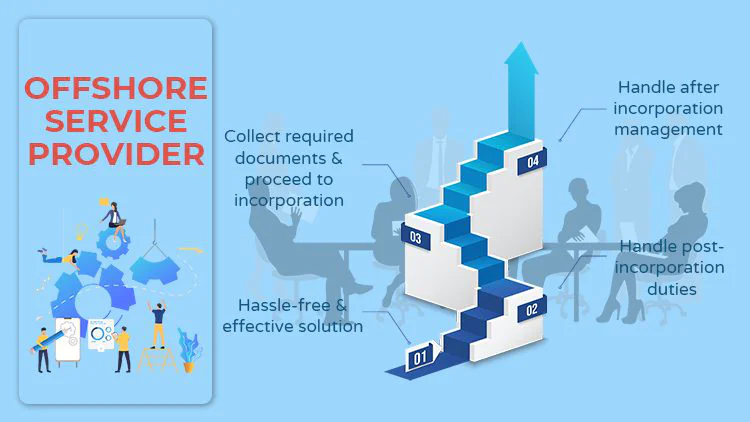

Hiring a good offshore service provider is one hassle-free and effective solution for most new business players. To clarify, the service firm will collect required documents and paperwork, then register and incorporate your offshore company. Moreover, this firm is also able to facilitate the management of administrative tasks for you after the incorporation. Examples of post-incorporation duties include making renewals, filing financial reports, annual tax returns, and so forth.

Please keep in mind, not all offshore service providers can be your ideal partner. There are some parameters that should be taken into account, prominent among which include:

- The experience/business history of the firm

- The physical location of the firm

- The number of jurisdictions that the firm may cover (if you choose universal providers)

- The cost of the firm’s services

- The customer service of the firm

- Especially, the reputation of the firm

Last but not least, in your very first stage, you should be well prepared for associated payments. Once you have selected your ideal partner for offshore company formation, you actually know how much you need to pay for your basic incorporation. Typical payments are fees for certificate of incorporation, the register of directors, or document filing. Having said that, there can be other additional fees that you should plan in advance. Such extra payments can arise from some following activities:

- Bank account opening

- Corporate seals registering

- Corporate offices renting

- Together with a couple of possible needed services like apostille, virtual office, etc.

Free ebook

About to start an offshore business? This manual covers all you need to know when going offshore:

- Roadmap to offshore company formation

- How-to guide to offshore bank account registration

- Introduction to international rules in offshore landscapes

Company structure: IBC, LLC, Pte Ltd – Which to choose?

The next stage is to consider a suitable offshore company structure!

Offshore company is a very broad term. Depending on the jurisdiction you have selected, the flexibility of the business structure you expect, and some other factors, the offshore service provider can suggest the best-suited type to make the most of your benefits.

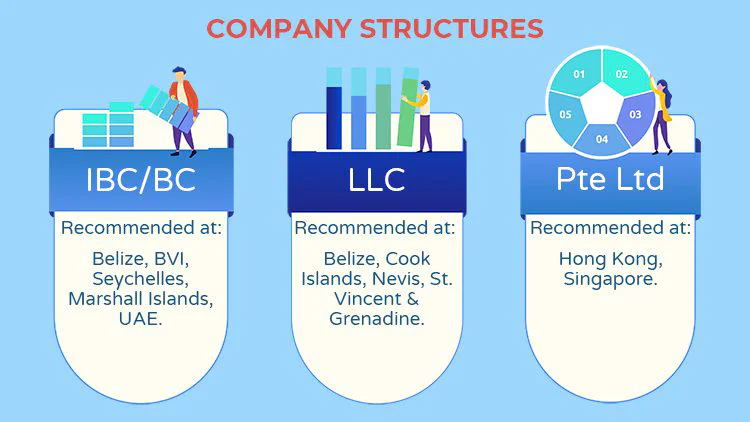

Normally, there are 3 offshore company structures widely chosen by business players moving offshore. They are:

Main features of International Business Company/Business Company (IBC/BC)

- Allow the engagement in international business activities like trade or investment

- Enjoy a very low tax rate (or be exempt from local corporate tax), if the IBC does not conduct business within the jurisdiction of incorporation

- Offer fast incorporation

- Offer banking and corporation privacy

- Offer minimal reporting requirements

- Require at least 1 director and 1 shareholder (both can be the same person)

Recommended offshore jurisdictions: Belize, BVI, Seychelles, Marshall Islands, UAE

Here is an example to let you explore more about this type: Seychelles International Business Company (IBC): A Go-to Guide

Main features of Limited Liability Company (LLC)

- Be a hybrid of the corporation and the partnership

- Be exempt from local corporate tax on assets or income-generating outside of the jurisdiction of incorporation

- Offer strong protection for the company members. Members are not personally liable for debts or liabilities of the business

- Only have members in place of shareholders and directors

- Offer minimal reporting requirements

- Require at least 1 member

Recommended offshore jurisdictions: Belize, Cook Islands, Nevis, St. Vincent & Grenadine

Belize Limited Liability Company is a typical case. Check it out!

Main features of Private Limited Company (Pte Ltd)

- Be a type of privately held business entity with the number of shareholders not exceeding 50

- Offer limited liability to shareholders

- Can enter into contracts, acquire assets, sue or be sued under its own name

- Enjoy low tax rates/tax exemption from income earned from outside

- Restrict shareholders from publicly trading shares

- Subject to more reporting requirements than that of IBCs

Recommended offshore jurisdictions: Hong Kong, Singapore

Want to know about Hong Kong Pte Ltd in detail? This blog gets you covered: All you should know about Private Company in Hong Kong

Insights

Some factors may affect your decision on determining a structure for your business such as company size or business sector. Take a look at our recommendations, you may find your situation and get an appropriate solution:

- If you need a structure to manage and hold assets of all of your existing companies but don’t take part in day-to-day business operations, an offshore holding company is the perfect fit. A holding company is usually registered under a corporation or an LLC and acts like a parent company.

- If you are confused about which business to choose for your company, offshore international trading company is a recommended option. Thanks to the nature of international trading and the development of free trade networks, going offshore with this type of business can take many advantages.

- Offshore Company for Cryptocurrency has become popular for recent years due to the emerging of virtual currency. An offshore company is an ideal choice of business entity with high level of corporate privacy, asset protection and tax advantages as key feature of an offshore jurisdiction.