So, how do offshore companies work?

Offshore companies operate according to the local regulations and law acts of where they are incorporated. Normally, investors choose a foreign jurisdiction that has more favorable policies than their home countries. Then, they set up a company and start a business there in order to enjoy the benefits from such policies.

For instance, if you opened and managed your company in Australia, its worldwide income would be subject to the corporate tax rates from 25% to 30% (depending on the business size). However, if you registered a company in Hong Kong, its income would only be taxed from 8.25% form 16.5%. On top of that, the income that is earned outside of Hong Kong can be completely exempted from local tax.

Corporate giants do this all the time. Apple, Samsung, Google, Berkshire Hathaway, they all have established offshore companies as their subsidiaries in many countries all over the world. Making use of favorable policies while still complying with them, these giants legally reduced their payable taxes by a significant amount.

You don’t need to get a business as large as these corporations to consider building your own offshore company. As long as you have a thorough plan, you can start your offshore business right away.

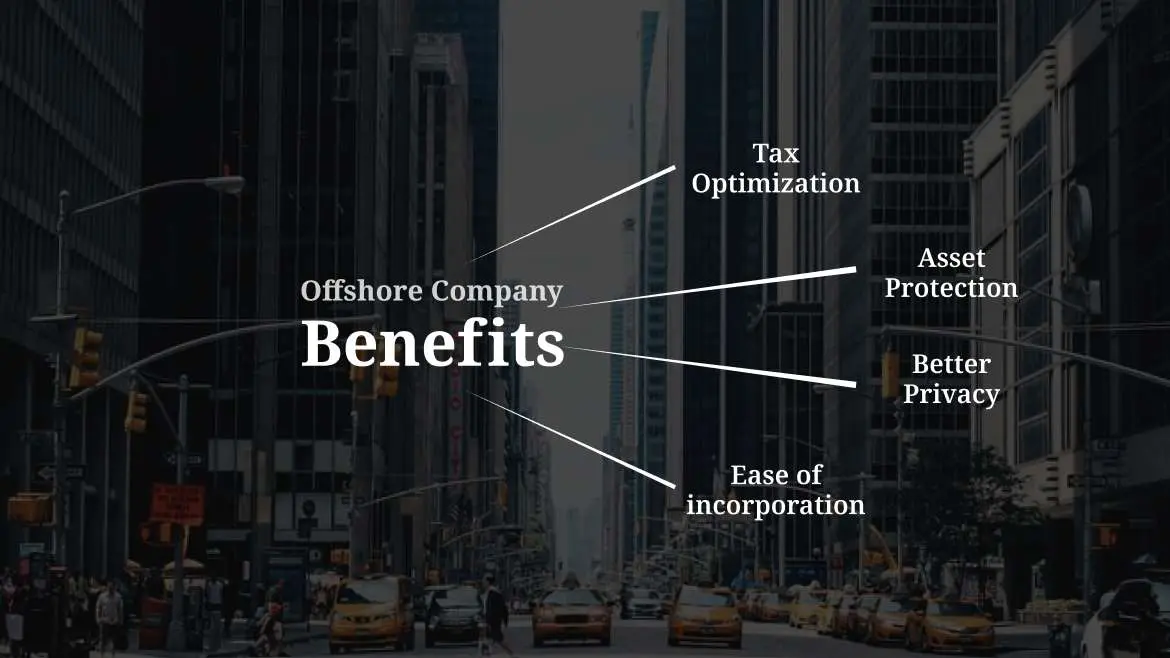

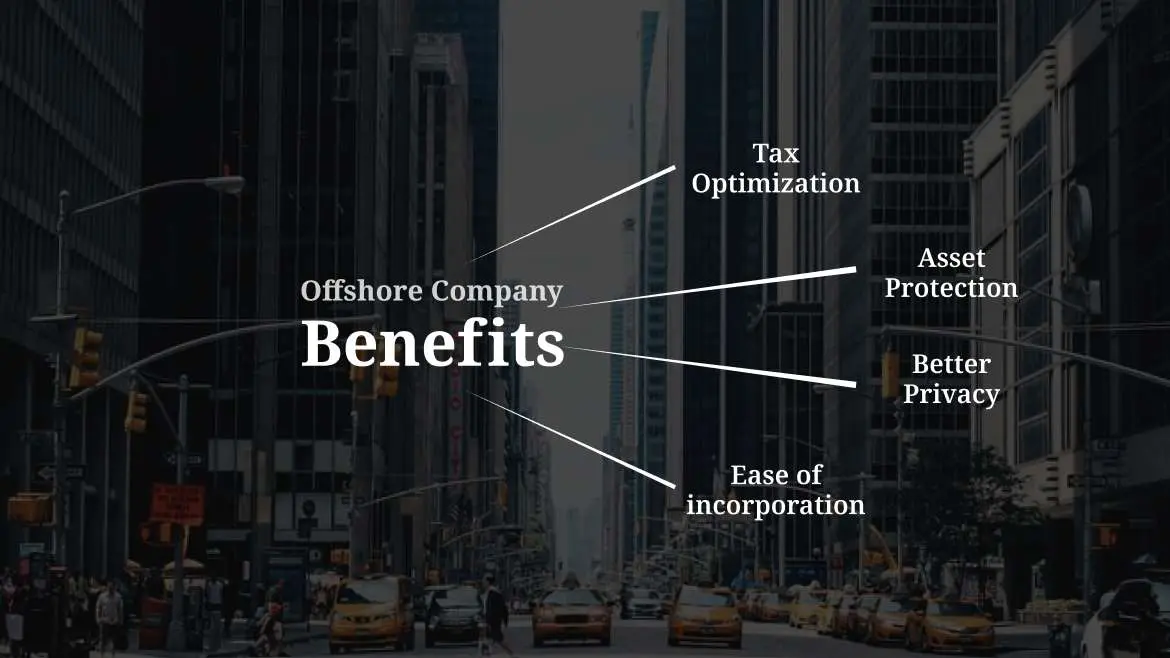

Part 2: The Benefits of an Offshore Company

“How can I benefit from an offshore company?” is a common question. Tax optimization lies on top of the list. But offshore companies can offer you more than that. Other typical benefits include better privacy, asset protection, ease of incorporation, and low-cost maintenance.

Tax Optimization

Some countries impose ridiculously high tax rates on corporate income.

The rates are 37.5% in Puerto Rico, 30% in Germany, and 25% in France

That’s why thousands of entrepreneurs out there have decided to go offshore. If you find yourself in this situation, then following the offshore path is the right choice.

Tax optimization does not necessarily mean to evade taxes. Breaking the law is not a wise thing to do. When seeking tax solutions, you should comply with both the laws in the incorporated jurisdiction and your home country.

You can search on Google and easily find out many places where the income tax is much lower than your home country. These places can be grouped into 2 main categories: no tax and low tax.

No tax jurisdictions

If you aim for the former group, you should consider everything carefully. Some no-tax jurisdictions are changing their policies fast. They are starting to impose taxes and regulations on certain kinds of income and business activities. And some places have a really bad reputation in the business world. These are the ones you should avoid.

Bad-reputation jurisdictions would cost you a hard time opening a bank account and running your offshore company. In particular, banks in Singapore or Hong Kong are very concerned about opening an account for companies in tax havens. The same goes with customers and clients. They would also be concerned to do business with your company if it is incorporated in such jurisdictions.

The pressure definitely is on choosing the right place. Incorporating in a wrong jurisdiction with unsuitable policies can cost you severe consequences and a waste of resources. That’s why thorough planning and research is a must (or at least the right consultation from the real professionals).

Here is an example for offshore planning:

You open a company in the British Virgin Islands (BVI) to provide services overseas. You also establish your company’s management in another country to make it not a BVI-resident for tax purposes. These will ensure no corporate tax will be paid in this jurisdiction.

And since BVI has a fair reputation, you can open a corporate bank account in Singapore. This will allow your company to receive money from customers with ease.

If necessary, you then need to establish your tax residency in another country where you can receive your business money without being taxed.

Low tax jurisdictions

On the other hand, there are low-tax countries. They are more stable, well-recognized, and respectful when compared to tax havens (certain tax havens are changing their regulations – we will discuss this matter later in this blog). Companies incorporated in Singapore or Hong Kong can easily open their bank accounts and do business in many other places, as these countries are known to have good reputations and well-structured legal frameworks.

Many low-tax countries adopt a territorial tax system. This means only the income generated from within these countries is subject to tax (while foreign-sourced income is not). Furthermore, these countries usually have a network of international tax treaties, which can bring you tax reduction and even exemption. These are a big plus besides their minimal tax rates.

So, if you accept paying a small amount of tax in return for respect and stability, low-tax jurisdictions can be the right choice.

Better Privacy

Generally, it is a must for companies to register and maintain their profiles and data with the Company Registrar. However, you can feel secure as all information of identity would be kept confidential.

Many offshore countries shall not disclose the company’s beneficial owners, directors, and shareholders to the public, except in certain cases like a court order or international arrangements between related overseas jurisdictions.

Asset Protection

Many jurisdictions provide an excellent cover for your assets. Besides financial privacy policies, you can benefit from the foreign judgment denial. This means, your assets are shielded against the judgment made by foreign courts. Only the court of the incorporation jurisdiction can place a judgment on the assets.

For instance, if you formed a trust in Belize, the trust’s property would be shielded from any claim according to the law of another jurisdiction. The only judgments that are recognized in Belize are those made by the Belize government. Trust is one of the most ideal vehicles for your asset protection.

If you looking for a business vehicle for asset protection, look no further than offshore trust.

Some other common offshore centers that offer financial privacy are the BVI, Seychelles, Cayman Islands, and Nevis.

Ease of Incorporation and Maintenance

The offshore incorporation process is rather simple and fast. In fact, you can register a company in certain countries just within a few days. The incorporation requirements are normally very minimal.

The best thing is that many service providers out there can help you with the registration. All you need to do is find a trustworthy provider, pay for service, and supply necessary documents. They will go on and register the company on your behalf. You do not need to travel or care about the hassle of paperwork.

As for the company maintenance, it varies according to different jurisdictions. However, you can expect the reporting requirements to be very minimal too. Some countries also offer many exemptions for small businesses in regard to annual compliance. You can always get help from outsourcing services to relieve the burden of accounting or tax filing requirements.

Part 3: Some Best Countries for an Offshore Company

There is no such thing as one best offshore jurisdiction that all entrepreneurs agree on. Every offshore jurisdiction has its own set of policies and related regulations. Thus, each one brings you different advantages that fit your current needs.

When you choosing a jurisdiction for offshore incorporation, you should consider the following matters:

- Main goals when opening an offshore company

- Stability and reputation of the jurisdiction

- Taxation (low tax or no tax and the availability of other tax benefits)

- Investment opportunities (the markets and government treatments)

- Type of business entity

- Incorporation process (processing time, incorporation requirements, and cost)

- Annual maintenance requirements and fees

- Citizenship (if you plan to live there permanently)

- We have listed out some popular countries where you should take into account for your offshore company incorporation:

Belize: If you are looking for an offshore jurisdiction with a competitive price, fast incorporation, and ease of banking needs, do not miss out on Belize in your consideration list.

Cayman Islands: Located in the western Caribbean Sea, this is a very common choice for most foreign investors who are seeking tax-free benefits.

The British Virgin Islands: BVI and Cayman Islands share many common features. But a plus is that the incorporation cost in the BVI tends to be much more affordable than that in the Cayman Islands.

United Kingdom: The UK is ranked in the top 10 nations worldwide for ease of doing business by the World Bank. A large network of tax treaties (with 130 countries) is also an advantage to consider this country.

Seychelles: The country is positioned as a place of favor for manufacturing and trading between Africa, Europe, and Asia. Incorporating a Seychelles IBC is an option to go among many choices of a tax haven.

Hong Kong: Startups, SMEs, foreign investors are big fans of Hong Kong. Two key highlights to urge business people to move to Hong Kong: Two-tier profits tax system, and its strategic location as a gateway to Mainland China.

Singapore: This is a promising destination for offshore seekers, especially fintech enterprises. Its reputation, supportive trading platforms and friendly tax regime are persuasive reasons leading Singapore to a top of choice.

Part 4: General Offshore Incorporation Process

After finalizing the place of incorporation and having your offshore plan ready, the next step is to set up your company. Here is the general incorporation process. Please note that things may get slightly different according to different jurisdictions.

Choose the Type of Business Entity

There are tons of different types of business entities. Each type will bear different key characteristics. When choosing your type of entity, you should consider the following aspects:

- The entity legal status

- The liability of the entity

- The tax and other benefits of the entity

The advice is to go for the type of company that has a separate legal status.

This allows your company to hold its own liabilities. It can enter contracts, agreements, buy and sell property, take loans, sue, and be sued in its own name. You and other shareholders/owners will not hold any personal liability that goes beyond the capital contribution.

In case your company got into big debts or even went bankrupt, the only loss you would bear is the money for capital contribution. Other personal assets would still be safe in your home country. A separate legal entity guarantees you a high degree of safety.

That said, there are still cases where you may find that a partnership or other special structures are more beneficial. And it all depends on your specific situation.

Get a Professional Service Provider (Recommended)

Each jurisdiction has a different set of requirements and incorporation process. Some jurisdictions advise foreigners to register their companies through the services of a licensed provider. The reason is that foreigners do not have specific tools and accounts to register on their own.

Even when it is not compulsory, you are still recommended to use an incorporation service. Of course, you can do it yourself but that would cost tons of time and effort. So why not leave the hard work to the professionals?

They have more experience and know exactly what needs to be done. The big plus is their services usually come in one package, which can help you easily satisfy all incorporation requirements.

All you need to do is find a trustworthy provider for your offshore incorporation, pay for the service, and supply required documents upon request. They will take care of the whole registration process so you don’t need to deal with hassle paperwork. No travel is needed. All can be done online.

After your offshore company is registered, the service provider can continue to support you on other post-incorporation matters such as bank account opening and tax (these are painful).

Do KYC Procedure

Upon the successful payment for the service, the provider will ask you to provide certain kinds of information and documents. This is known as the know-your-customer procedure (or KYC). Normally, the required documents include:

- The address proof of the shareholders and key members

- The company name

- The main business activities

- Other supporting documents (if needed)

Once collecting everything needed, the service provider will start to register an offshore company on your behalf. They will proceed to file an application and submit it to the local government for approval.

If you aim to do it by yourself, you will need to file everything and submit it to the local company registrar.

Part 5: Bank Account for Offshore Company

Your offshore company is ready, but that’s not enough to start the business. It needs a place to store its money when transacting with clients, customers, and business partners.

Opening a bank account is always the top concern for business owners. An offshore bank account is very important because it is the best way to separate your business money from your personal assets.

You can open your company and its bank account in the same offshore jurisdiction. However, many jurisdictions allow your company to open an account in another foreign country. For example, you can register a company in BVI and open a bank account in Singapore.

You can consider another jurisdiction to open a bank account to seek better tax optimization, better security, services, and interest rates, or currency diversification. Here is an example list of popular offshore jurisdictions for banking:

- Switzerland

- Belize

- Hong Kong

- Singapore

- Cayman Islands

- The British Virgin Islands

- Puerto Rico

- Mauritius

In most cases, the provider of incorporation service also supplies bank account opening service. And you should use this service too. Each bank has a different set of conditions to approve your application. If you do not have experience in dealing with offshore banks, the process can get very messed up, and this can result in unpleasant consequences.

A professional will help you choose the right bank for your business, generally review your current situation, file a well-prepared application, and apply it to the bank on your behalf. They make sure everything is done correctly and stays on the right track.

As mentioned above, opening an offshore bank account is not an easy task. And you will want to do it in the right way.

The Rise of Financial Institutions

Due to the difficulty of applying with traditional banks, many global business owners have turned to a fin-tech solution. Many financial institutions are now capable of providing you with a corporate account that can function just like a traditional bank account.

Your offshore company can still transfer and receive money from customers internationally. The network of money transfers can go as large as 80+ countries. Multiple currencies are also supported (can go up to 50+ different currencies).

The best part is that the application process can be done completely online in a short period of time. The afterward interview for verification can also be done online. These are big advantages over traditional banks. Banks normally have a much-more-hassle process and they require you to have a direct meeting with them for an interview (a few do accept online interviews).

Some most popular example for financial institutions are:

- Wise – formerly Transferwise (UK-based)

- Neat (Hong Kong-based)

- Payoneer (US-based)

Before making a decision, you should weigh your options between traditional banks and these financial institutions. Again, consultation from professionals is highly recommended. We have experience in dealing with banks and we are also partners with the above institutions. Contact us now to save your time!

Part 6: Typical Uses of an Offshore Company

Now you get the idea of an offshore company and how to build it. Let’s go deeper into the common particular use of them.

Trading business

Using offshore companies for trading business purposes is very popular. With the development of technology, now you can set up an online business without any hassle. You can register your offshore company in one country, get supplies from another and sell them to a third nation, while managing your company right at your home.

When choosing a jurisdiction for international trading, here what you should consider:

- The tax policies

- The incorporation process and filing reports

- The requirements for licenses and permits

- The targeted markets and other related issues

- Certain existing international rules and regulations

Hong Kong and Singapore are 2 good examples. They follow a territorial tax system and have a network of international tax treaties. These tax treaties bring you reduced tax rates and even tax exemptions on certain kinds of income when it is transferred from one signing country to another.

Hong Kong is the gateway to a huge potential market in China. Meanwhile, Singapore has one of the best banking systems and financial services in the world. These are the typical characteristics that can greatly benefit your trading business on a global scale.

Holding business

Your offshore company can hold a number of shares in another foreign company and receive dividends as a main source of income. It can also hold other types of assets like patents and trademarks, rent them or sell them overseas to make profits.

For holding business, you should consider countries with strong intellectual property (IP) regimes to ensure privacy and protection for your assets. Additional network of international tax treaties is a plus. Don’t forget to look into the international rules and how dividends, royalties, and other related income are taxed in both your place(s) of incorporation.

Cryptocurrency

Cryptocurrency is now more popular than ever. It is being traded in and out due to the potential of huge profits. More and more offshore companies are being used as a vehicle to enhance greater benefits for cryptocurrency transactions.

However, you should beware that setting up a cryptocurrency-related business is not so easy. Many jurisdictions do not allow crypto-related activities. And opening a bank account for a crypto company can be a real pain.

Part 7: The Fast-changing of Offshore Landscapes

The offshore environment has changed a lot. This is a result from the practices of the EU and the OECD during recent years. To align with the accepted EU standard, there has been a massive transformation with regard to the taxation and company legislation in some landscapes where we often called “offshore” jurisdictions. What are the remarkable changes?

Removing ring-fencing

This is one of the very first responses that many countries considered when it comes to the adjustments of preferential tax regimes.

Gone are the days when an International Business Company in many traditional financial hubs like Saint Vincent and The Grenadines are ring-fenced. These days you can find that both residents and non-residents get the right to start business with this type of company, and they can trade with local residents as well.

Economic substance rules

A large number of companies are reaping benefits from a favorable tax regime, but importantly they have no economic substance in the jurisdiction. The debates arose as people need more transparency and clarification for the legality of offshore structures. Many well-known offshore business centers have been increasingly taking step by step to implement the economic substance regime.

Generally, economic substance requirements are applicable for certain businesses such as pure equity holding companies, financial services, banking and insurance businesses, regulated businesses, and so forth. The economic substance rule was enacted in many offshore jurisdictions such as Belize, The Cayman Islands, The BVI, and many others.

Beneficial ownership regulation

Further legislative adjustments to the offshore industry can also be found with the presence of the Beneficial Ownership Act in several countries. Accordingly, in-scope companies in places where this rule came into force must verify the identity information of their beneficial owners to the competent authority via their registered agents.

Those are some key changes to offshore landscapes you can find recently. For better improvements towards transparency, you, as non-resident entrepreneurs, may expect to witness more revisions and updates in the upcoming time. The advice for you, please spend time examining the system of law in relevance to your offshore company jurisdiction before moving.

Or, again, seek advice from professionals who will let you know what should be done with your offshore planning.

The Bottom Line

Yes! We have just walked through many offshore company benefits, the procedure of going offshore, and some insights into recent extensive changes to offshore jurisdictions.

A large number of entrepreneurs and investors have been flocking to many ideal jurisdictions to start their business: Belize, the British Virgin Islands, the Cayman Islands, Seychelles, Nevis, and many others.

Depending on your company goal, you can generate different ideas when coming to offshore incorporation. It definitely takes great effort and time to make a thorough plan on the place of incorporation and what to do with your offshore company. A wise choice is to seek trusted incorporation services for consultation and support.

Interested in internationalizing your business and keeping your assets safe? Wonder about how an offshore company can optimize your company’s tax burden? Wish to get an in-depth guide to offshore company formation in our 20 global serviced countries?

Drop us a message now to clarify your queries!